Bridging the financial education gap

Image credit: goHenry

A recent OECD international study on financial literacy showed that only 57% of adult respondents obtained the minimum target score of 5 for financial literacy. Younger adults, aged 18-29, were found to score the lowest. Saving habits were particularly bad, with one-third reporting a saved financial cushion of one week, while one quarter said one month.

Financial education from a young age is seen to provide a bridge to help to improve savings behavior.

According to a survey commissioned by the Austrian Bankers Association in 2021 the topic of financial education for children has become even more important in every second family, as many Austrian families had to restrict themselves financially during the pandemic. Parents have recognized the importance of teaching their children how to handle money well and wish for support from competent financial knowledge providers such as schools and banks.

However financial education in schools seems to be very often insufficient. The main problem that researchers found is that the amount of theoretical knowledge exceeds the number of practical knowledge.

Not to forget, the shift towards digitization in finance, and away from cash, further accelerated by the pandemic, affected kids as much as adults. Because a physical 10 euro banknote is useless for buying extras on Nintendo´s Animal Crossing or downloading a game on the PlayStation Store. Also, the fact that traditionally children can’t even get a debit card until they are 11 in the UK, and 13 in the US, accelerated the need for new solutions directed at kids and teens.

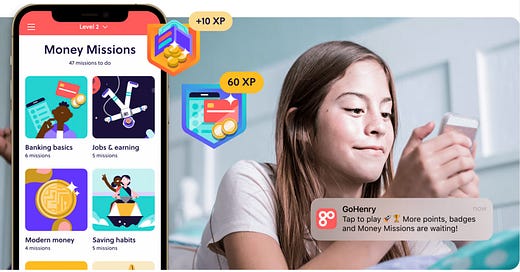

For a long time, the UK market was considered a forerunner in digital financial solutions for the younger generation. UK success stories like Osper or goHenry, which cater to the younger generation, proved the willingness of parents to pay for financial literacy tools, that teach children money management skills. Other providers like Revolut or Starling bank pioneered the idea to bind the customer to their own brand by a very young age with offerings like Revolut <18 or Starling Kite.

The latest additions to the German Fintech market demonstrate the shifting interest toward kids & teens banking in Central Europe. Whether it’s the pocket money app bling, the social interactive banking app Ruuky, the family savings app Clanq or the social banking platform owwn, all of them aim to help young people understand the value of money, make pocket money easier, and support their first purchasing experiences.

Financial institutions in the Central and Eastern European areas are showing a big interest in dedicated apps for children and are trying to find revenue streams within this group. As presented by Szymon Staśczak (Head of CEE Visa Consulting & Analytics) at this year´s Unchain Fintech Festival in Oradea, Romania, this trend is driven by children's interest in purchasing their dream items, especially in the group of 7 to 10 years old, and in online shopping, which applies to the group of 11 to 14 years old.

One of the first solutions from our CEE countries is the SMARTIE App developed by 365.bank, which is the digital spinoff of the Slovak Post bank. SMARTIE offers a children´s payments card, a bracelet for contactless payments, and a separate mobile app for children aged 8 - 15 and their parents. In the app, children can learn how to save, solve educational quizzes, and unlock colorful themes. The goal is to teach children responsibility, and the value of money, and help build a healthy relationship to savings at a young age.

Because by teaching children about money management, once they are independent, they will have the financial skills to avoid potentially costly mistakes.

The Latest:

📍Revolut Pay Launch

Image credit: Revolut

Revolut launched Revolut Pay, a one-click payment feature available across product, cart, and checkout pages. Consumers can pay with just one click and earn cashback on purchases as they spend. Revolut Pay brings the most advantages for merchants who can accept payments with lower fees in more than 20 currencies. Funds are settled directly into a merchant’s Revolut Business account within 24 hours at no extra cost. The payment feature is running on Revolut’s in-house software and is already being used by merchants including Shopify, Prestashop, WH Smith and Funky Pigeon.👉🏻 Explore Revolut Pay here

📍 Revolut Pro Launch

Image credit: Revolut

Revolut Pro is a separate space with a dedicated IBAN within the Revolut app that has been launched to enable access to simple business tools for freelancers, casual sellers, side hustlers, and gig workers. There is a 1% cashback on all card purchases, no fees, deposit or balance requirements, or credit checks. Revolut Pro enables independent professionals to instantly accept payments, either in-person with Revolut Reader or online with QR codes and payment links. The service helps generate invoices and track payments. Revolut Pro blurs the line between Revolut’s consumer app (20m users) and its Revolut Business app (500k businesses and self-employed workers). 👉🏻 Explore Revolut Pro here

📍 Shares.io Expands To Germany

Image credit: Shares.io

The French social investing startup Shares.io is expanding to Germany and preparing the launch in Germany, Austria, and Switzerland in the 4. Q. The company just recently introduced in-app Shares Communities, which connects investors based on interests, like ethical investing or web3, as well as through stock-specific groups, such as Tesla or Apple. Verified users can follow friends’ investment activity in real-time, comment or add reactions to them, and even discuss strategies in group chats. 👉🏻 Explore Shares.io here

📍 Scalapay Austria launch

The latest addition to the buy now pay later market in Austria is the Milan-based company Scalapay. The service offers 3 interest-free installment payments. Brands and retailers that use Scalapay’s services include Decathlon, Calzedonia, Samsonite, Nike, and Pandora. 👉🏻 Explore Scalapay here

📍 Polish BLIK to acquire Slovak Viamo

Polish Payment Standard (PSP), the operator of the BLIK mobile payment system with over 11.3m active users, is acquiring Viamo, a provider of peer-to-peer (P2P) and business payment services in Slovakia. Viamo has been operating in the Slovak market since 2013, has over 300k users, and is currently working closely with Tatra Banka and VÚB banka on the local market. 👉🏻 More here

📍 ING to phase out Yolt

Yolt began life as a consumer-facing money management app back in 2017. In September 2021 ING repositioned Yolt as ‘Yolt Technology Services’ with a pure business-to-business open banking offering. Less than a year after, ING is shutting down its consumer-facing smart money app. 👉🏻 More here

📍Plum expands in Europe

UK savings and investment app Plum is launching commission-free stock investing and a debit card for its customers in France, Belgium, Spain, and Ireland. Customers of Plum's free Basic subscription can access more than 500 US stocks. They can invest as little as € 1 through fractional shares in companies such as Google, Tesla or Amazon. The new Premium tier, priced at € 9.99 per month, will offer a broader range of stocks, amounting to 3,000. Founded in 2016, Plum now has 1.3m users. 👉🏻 Explore Plum here

📍 Plaid Europe launch

The powerful US player Plaid has long analyzed important markets such as Great Britain and Germany. Despite the strong competition by Tink, the open banking provider is recruiting a team for expansion in Europe. With a license in the Netherlands, Plaid already has its first corporate customers in Germany, such as the crypto provider Kraken. 👉🏻 Export Plaid here

📍 Swan launch Austria

Solaris competitor Swan expands to Germany and Austria. Founded in 2019, the fintech offers white-label banking solutions, with a necessary e-money license in France. The Paris fintech Swan has 50 business customers in eight European countries and, according to its own statements, processes transactions worth more than 200 million euros per month. 👉🏻 Explore Swan here

Good read

📚 The Financial Brand INSIGHTS Magazine /Fall 2022 issue 👉🏻 Read here

Twitter finds

The new App for Android is here 🥳