Combatting Financial Fraud in the Digital Age

Revolut's Call to Action

Market Status

In an age where the digital and physical worlds blend effortlessly, financial fraud has evolved into a sophisticated threat, exploiting the widespread reach of social media. The 2023 Financial Crime and Consumer Security Insight Report by Revolut highlights this growing problem, showing how fraudulent activities are increasingly leveraging social media platforms to deceive and defraud unsuspecting users.

According to Revolut, nearly eight out of ten fraud cases (77%) reported to the fintech in the European Economic Area (EEA) during the second half of last year originated from social media platforms.

As stated by the Head of Financial Crime at Revolut, Woody Malouf, to the German media outlet IT Finanzmagazin, the situation in Germany is similarly dire, with 72% of fraud cases in the latter half of 2023 originating from social media. Meta platforms, such as Facebook, Instagram, WhatsApp, and Messenger, were particularly problematic, accounting for 55% of fraud cases and 37% of the resulting financial losses. Across the EEA, these platforms were implicated in almost two-thirds (61%) of reported fraud cases, responsible for about 40% of all stolen amounts.

Identify & Act

Revolut identified two primary types of social media fraud in the EEA in 2023: investment scams and purchase scams. Investment scams promise quick wealth in exchange for large investments, although they account for only 12% of cases, they represent 61% of the total money lost. Purchase scams involve customers being deceived into buying items that do not exist or are not as described, accounting for 18% of lost funds and being the most common type of fraud.

The report underscores the urgent need for financial institutions to bolster their defenses. With advancements in technology, banks and fintech companies need to deploy cutting-edge AI-based algorithms and biometric tools to combat fraud.

To protect its customers, Revolut cracks down on fraud with a proprietary detection system leveraging machine learning and AI to analyze over 590 million transactions monthly, continuously adapting to emerging threats with advanced security features like RAT detection, virtual disposable cards, and flexible early warning systems.

Recently, Revolut has launched an advanced AI-powered scam detection feature, designed specifically to identify and prevent APP (Authorized Push Payment) scams.

This feature can determine if there is a high likelihood that a customer is making a card payment as part of a scam and, if so, decline the transaction. It then guides the customer through a scam intervention process within the app, prompting them to provide additional transaction information and showing educational stories to help them recognize potential scams. If necessary, customers can be redirected to chat with a Revolut fraud specialist for further assistance. Since its initial testing, this feature has led to a 30% reduction in fraud losses from card scams related to investment opportunities.

Revolut's efforts are part of a broader push within the fintech industry to combat online fraud. For instance, Monzo, as the first UK bank, has introduced a "Call Status" feature, that allows customers to verify the legitimacy of calls that claim to come from Monzo.

If the 'Monzo Call Status' indicates that the caller is not a member of the Monzo team, customers should hang up immediately and report the incident by tapping the call status. In case of no internet connection, the call status will reflect that, and Monzo advises customers not to engage with anyone claiming to be from Monzo until they can reconnect and verify the call status. This feature helps prevent impersonation scams, which cost UK consumers over £177 million in 2022. However, data from Revolut indicates that impersonation scams constituted only 4% of all authorized fraud cases (APP fraud) in 2023.

Revolut Urges EU Action

In light of these findings, Revolut has appealed to the European Union to take decisive action. The Fintech giant is urging national ministries and EU institutions to focus more on combating fraud at its source, social media platforms, rather than solely addressing fraud involving the impersonation of bank employees.

In 2023, the European Commission proposed new legislation, including the Payment Services Regulation (PSR), to introduce measures against fraud that mimics banking transactions. The latest directive by the European Council on how to fight non-cash payment fraud dates back to 2018.

The Latest

Salt Bank Takes the Market by Storm 🇷🇴

Salt Bank, Romania's pioneering 100% digital neobank, has officially hit the market as a subsidiary of Banca Transilvania Financial Group, following the acquisition of Idea Bank. Offering a user-friendly app, checking account, and multi-currency card facilitating transactions in 17 currencies worldwide, Salt Bank stands out with its enticing 3% yearly interest on main current accounts and Spaces feature, requiring monthly payments of at least 1,000 lei. With a focus on individuals for now, Salt Bank has seen an impressive 40% growth within just one day of launch and immense interest from Romanian consumers, particularly through its innovative Founder program rewarding early enrollees with exclusive benefits and potential future shares. Powered by the BaaS platform Engine by Starling Bank, Salt Bank is aiming to attract 250,000 customers in its first year of operation and introduce lending services by the end of 2024, all while striving to achieve profitability within four years.

New Kid on The Block 🇨🇿

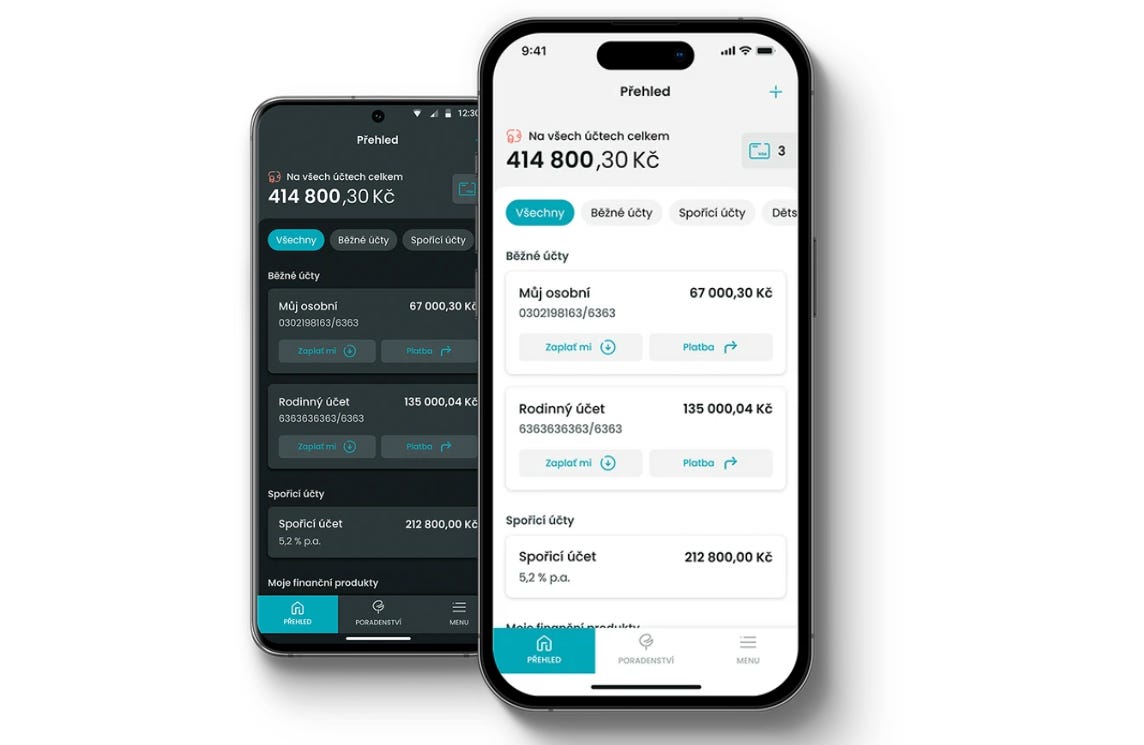

In March 2024, Partners Banka made its debut in the Czech Republic. As a part of the Partners financial group, renowned for its financial advisory services, Partners Banka emphasizes a blend of cutting-edge technology with personalized financial guidance.

Clients of the existing Partners advisory network can seamlessly access Partners Banka's services through their financial advisors or opt for online account opening via Bank ID, while non-clients can visit any of the 175 Partners branches. Boasting the fourth largest branch network, Partners Banka offers three distinct service packages catering to individuals, couples, and families, reflecting the evolving needs across different life stages.

Additionally, its innovative mobile app includes special versions for children and teens, empowering them to manage their finances responsibly while offering parents comprehensive oversight and control. Looking ahead, Partners Banka plans to expand its offerings to include unsecured loans and mortgages, with ambitious goals to acquire a significant market share and assets by 2030. With its strong foundation and backing from the Partners Group, which has experience in investments, insurance, real estate, and media publishing, the bank aims to revolutionize the banking experience in the Czech Republic.

Change Revolutionizes Investment Access in Czech Republic: Low Fees, Global Opportunities 🇨🇿

Change, the Estonian investment app, is expanding its services to the Czech Republic, aiming to address significant obstacles faced by investors in accessing foreign markets due to high fees. Through a partnership with Interactive Brokers, Change now offers Czech and European investors access to global investment opportunities with minimal fees since April. The platform allows investment in over 100 crypto assets, stocks, options, bonds, and futures with no management fees, a minimum investment of €10, and the option for fractional shares, catering to both novice and experienced investors. Additionally, clients can utilize a Visa payment card for transactions in over 100 cryptocurrencies worldwide. With over 130,000 users across 30 countries, Change is regulated in the Netherlands and Estonia, providing a reliable platform for international investors.

UniCredit Enhancing Accessibility for the Visually Impaired

On April 22, 2024, UniCredit announced its transition to Mastercard Touch Card™, enhancing accessibility for blind and partially sighted individuals. The new card design incorporates tactile notches on the sides—rounded for debit, squared for credit, and triangular for prepaid—to facilitate easy identification by touch. This initiative aims to empower visually impaired individuals across Europe, where an estimated 30 million people experience sight loss, fostering independence and inclusivity. Additionally, the card aligns with UniCredit's environmental, social, and governance (ESG) principles, featuring recycled PVC material and a Mastercard Sustainable Card Badge. Initially available in Italy, the rollout will extend throughout 2024 to cover all clients in the bank's 12 operating countries, encompassing approximately 20 million cards.

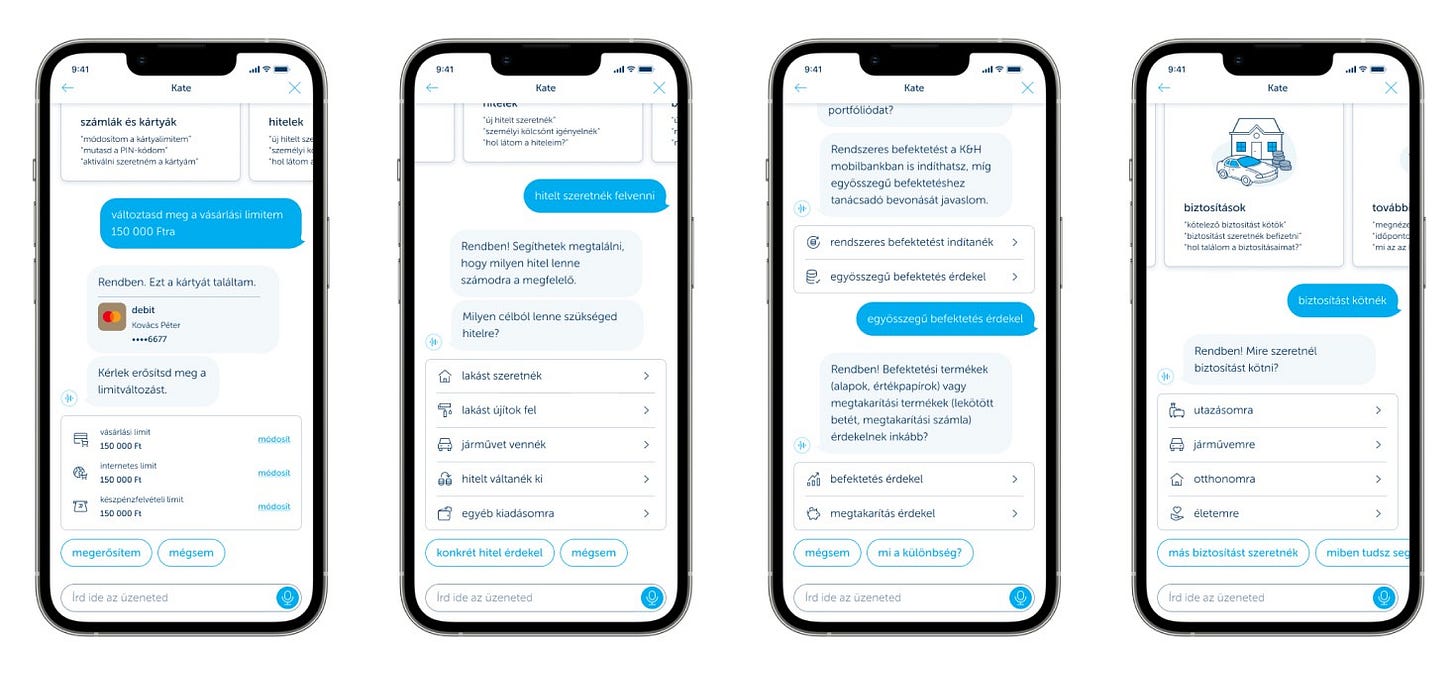

K&H Bank's Digital Financial Assistant Kate now Talking to SME’s 🇭🇺

Since spring, K&H Bank's digital financial assistant, Kate, has been aiding small and medium-sized enterprises (SMEs), marking a significant leap in digital banking solutions. Kate stands out as the country's sole AI-based assistant capable of understanding and executing voice commands, positioning itself among the most advanced technologies in the sector. With over 115,000 SME customers, K&H Bank recognizes the growing demand for digital solutions among businesses, offering Kate's services free of charge. Kate's capabilities extend beyond traditional banking tasks, including transfers, limit adjustments, PIN reminders, and card blocking, all accessible through voice commands. While initially introduced for retail customers in 2022, Kate has rapidly evolved, now seamlessly integrating into business banking profiles, ensuring a smooth transition between residential and entrepreneurial affairs. Moreover, Kate's user-friendly interface and personalized assistance have garnered praise, earning K&H Bank recognition as the best domestic digital bank of 2023. Looking ahead, K&H Bank plans to expand Kate's services to all business customers, reinforcing its commitment to innovative and customer-centric banking solutions.

Empowering Young Europeans: Birdwingo Launches First Investing App for Teens 🇪🇺

In May 2024, Birdwingo, a fintech company based in New York and Prague, unveiled its innovative investment app tailored for young Europeans aged 11-17. Securing a recent investment of 1.2 million euros, Birdwingo's platform allows underage teenagers to invest in popular stocks and ETFs with a minimum deposit of €1 and trade fees ranging from €0.01 to €1. The app provides a controlled environment where parents can set investment limits, approve trades, and manage account deposits. Additionally, Birdwingo offers a Smart Savings feature with a 4% annual interest rate, along with an engaging 'academy' that teaches essential financial skills through interactive lessons and real-life investing scenarios. Statistics from the beta testing phase show promising results, with 94% of teens reporting increased confidence in managing their money, 79% starting to save and invest for the long-term, and 84% of parents noting significant improvement in their kids' financial literacy. Birdwingo also incentivizes learning through its 'Learn to Earn' feature and plans to collaborate with high schools and non-profits to expand its impact. With over 20,000 users already onboard, the app is available on both the App Store and Google Play for €7.99/month or €59.99/year. While similar offerings exist in the US, Birdwingo fills a crucial gap in Europe by empowering teens with investing opportunities and financial education.

Raiffeisen Junior: Empowering Financial Literacy for Children and Teens 🇦🇹

Raiffeisen NÖ-Wien has introduced Raiffeisen Junior, a banking app designed for children and adolescents aged 7 to 14, along with their parents. The goal is to instill financial independence in children from an early age through features like gamification, task functions, and setting savings goals. The app allows children to make payments at NFC-enabled cash registers within agreed-upon limits, initiate transfers with parental approval, and send requests for pocket money. Moreover, it is directly linked to the parents' mobile banking app "Mein ELBA" and will be available at all Raiffeisen Vienna branches by the end of June.

Bitpanda Expands Cryptocurrency Services through Major Bank Partnerships

Bitpanda has forged partnerships with key banks to facilitate cryptocurrency access for corporate customers. Teaming up with Germany's largest federal bank, Landesbank Baden-Württemberg (LBBW), Bitpanda aims to enable firms like SAP and Siemens to custody and purchase cryptocurrencies like Bitcoin and Ethereum. The market launch is slated for the latter half of 2024.

Furthermore, Bitpanda's collaboration with Raiffeisenlandesbank NÖ-Wien expands its reach in Austria, extending services to 55 additional Raiffeisen banks in Lower Austria and Burgenland. These partnerships signify significant strides in Bitpanda's mission to democratize digital asset access and drive mainstream adoption.

Vivid 2.0

Vivid has initiated the migration process to its new money app, marking a significant step towards independence. With its own e-money license acquired through the purchase of Joompay in Luxembourg, Vivid is set to transition its customers from the Solaris system to its proprietary infrastructure. Branded as "new, shiny Vivid 2.0," the updated app boasts features like cashback, interest payments, and unlimited SEPA instant transfers, making it the first of its kind in the app store. Despite the anticipation, the extent of customer participation in the migration remains uncertain, with approximately 500,000 accounts in total and an estimated 200,000 active users.

#SPOTLIGHT-CEE:

Finax 🇸🇰

Finax, Slovakia's highest funded fintech startup since 2019, is disrupting the investment landscape by democratizing smart investing. Through passive investing in ETF index funds, Finax promises an average return of 4%, outperforming traditional mutual funds. Investors benefit from zero income taxes and low fees, with an entry fee of 0% and an annual management fee of 1% + VAT, lower than the industry average.

Moreover, Finax's system continuously monitors investments and suggests adjustments, ensuring optimal performance. The platform offers a range of financial products tailored to various investment goals, from building a financial reserve to planning for retirement through the innovative European pension (PEPP) scheme. Expanding beyond Slovakia to markets like the Czech Republic, Croatia, and Poland, Finax plans to establish a presence in Germany this year, with further expansion into Western Europe on the horizon. Additionally, Finax is committed to financial education, evidenced by its creation of a modern financial literacy textbook for primary schools.

With recent acquisitions, including retail investment activities from Belgium's Aion Bank, Finax aims to broaden its reach and offer its innovative PEPP product to a wider audience across Europe. Currently managing over EUR 140 million for 20,000 clients, Finax is poised for further growth and disruption in the investment industry.