Hello friends 🎅🏼

Thank you for all the ❤️ sent this way after the launch of Beyond George.

Hope you will enjoy this edition too.

Headline story: EU set to ban trading practice

Photo Credit: Financial Times

Ever heard about “Payment For Order Flow”? No?

But I am sure you heard about Robinhood or Trade Republic as one of the cool kids on the “trading” block.

Well, these companies enjoyed immense success in the last couple of years with their zero commission business models. These companies are heavily dependent on the Payment For Order Flow model.

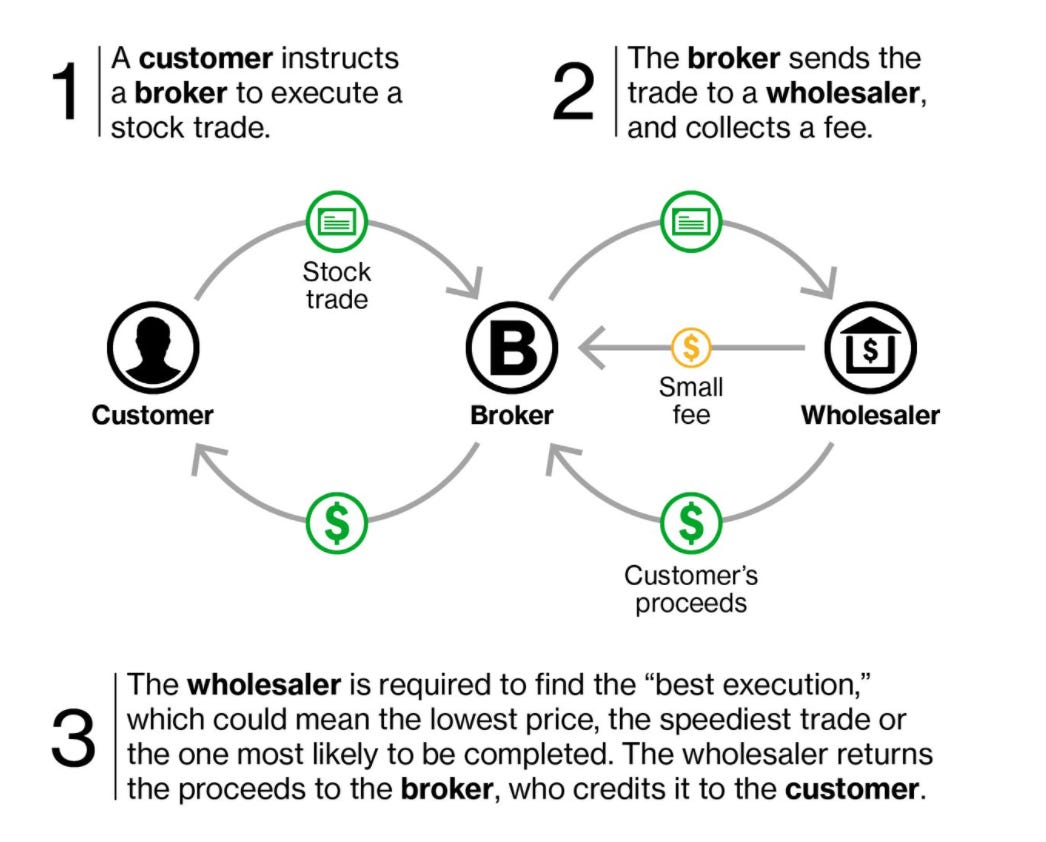

But first: What is PFOF?

Payment for order flow (PFOF) is the compensation and benefit a brokerage firm receives for directing orders to different parties for trade execution. (Source: Investopedia)

Photo Credit: Bloomberg

In the case of Robinhood, Payment For Order Flow involves Robinhood selling its customer's market orders to third parties, who execute them and earn fees for doing so, with a portion given to Robinhood as payment for routing the customer's order to that particular third party.

Robinhood gets about 80% of its revenue from PFOF. In the case of Trade Republic the financial year results for 2020/2021 are estimated to generate an amount of about € 75-100m commission income, from which more than half is likely to come from PFOF.

Payment For Order Flow has been criticized for creating unfair or opportunistic conditions at the expense of retail traders and investors.

After the “GameStop” mania hit the headlines earlier this year, resulting in the hearing of Robinhood by Congress, the US authorities started to contemplate a full ban of PFOF. Following the UK, Canada, and Australia where bans are in effect.

In July The European Securities and Markets Authority followed up with an issued statement about serious investor protection concerns regarding Payment For Order Flow, which resulted in the European Commission actively making moves to stem this practice.

A proposal published end of November 2021 (to amend MiFID II and MiFIR) contains a comprehensive “ban on any gratification for forwarding a securities order” (see article 39a). Which means a ban on so-called “Payment For Order Flow” commissions.

For Neobrokers this would mean that they would have to potentially raise the fee and set a higher price for orders. Or in the case of Trade Republic, it could become its own “exchange”, as it has enough customers to take over the processing itself.

And who would benefit from a PFOF ban? Presumably, the big stock exchanges, as considerable market shares would move back to them.

Despite the missing approval of the directive by the EU Parliament, by now, every company that relies on Payment For Order Flow should have a backup alternative.

The Latest:

📍 Dateio and UniCredit Bank Romania launching the ShopSmart platform. The program offers cashback directly via the SmartBanking mobile application of UniCredit bank. 👉🏻 More here

📍 Bunq brings local currencies to Europe with the rollout of multi-IBAN accounts. Customers can easily receive, convert, hold, and spend multiple currencies within one app. 👉🏻 More here

📍 Starling launches Bills Manager feature. The new feature provides customers with the ability to have a Direct Debit or Standing Order taken from money from a Savings Space. 👉🏻 More here

📍Bitpanda joins forces with French Neobank Lydia to offer platform for digital assets. The white label trading offer is integrated into the Lydia app via an interface, the transactions run directly via Bitpanda. 👉🏻 More here

📍 Zip completes acquisition of Czech BNPL firm Twisto. The acquirement means that the Australian Buy Now Pay Later provider Zip gains access to 27 European countries. Together, they will cover a wide range of product offerings like digital wallets, virtual cards, short/long-term installments, or bill payments. 👉🏻 More here

📍 ECB extends oversight of electronic payments to digital wallets and crypto-assets. A new oversight framework for electronic payments which will include coverage of stablecoins and other crypto-assets has been approved. 👉🏻 More here

📍 N26 cuts short on American Dream. After struggling to make more headway in the hard-to-crack US market, the German digital bank is re-refocusing on its European roots. 👉🏻 More here

📍 ING phases out Payvision payments arm. The process should be completed by Q2 2022. 👉🏻 More here

Five Fintechs that owned 2021

🏆 Juni - Neobank built for eCommerce merchants

Founded in June 2020 in Gothenburg, Sweden, Juni provides online banking for internet-first business customers. The company says its transaction volumes have tripled every month since launch. 🔎 explore Juni

🏆 Trade Republic - Europe’s largest commission-free, stock-trading app

The turnover of the Berlin-founded Neobroker grew by around 3600% in the 2019/2020 financial year. The turnover for 2020/2021 is roughly estimated to 75-100m euros with a considered customer base of 1.3 m. 🔎 explore Trade Republic

🏆 SaltPay - Pan-European payments and operations hub for small and medium enterprises

Since its founding in 2019, the company raised $700m in venture capital financing, has a $1bn+ valuation, and has completed six acquisitions in under a year. Several different payment brands now sit under the SaltPay group across Portugal, Hungary, the Czech Republic, Iceland and the UK. 🔎 explore SaltPay

🏆 Bitpanda - Fastest growing cryptocurrency trading platform in Europe

The Vienna-based company, which has been profitable for 5 years, has 3m users, a valuation of $2bn, and is on track to achieve 6x customer growth year over year. At the same time, the company said that revenues will increase sevenfold in 2021 compared with the previous year. 🔎 explore Bitpanda

🏆 Mollie - Latest fintech unicorn under the payment services provider

The portfolio of the Netherland-based company, valued lately at €1bn, includes Revolut, Netflix, and Spotify. Best known in the Dutch, Belgian and German markets for integrating with all the online shopping platforms and partnering with companies that build eCommerce sites, Mollie wants to become the payment provider that understands local European needs. The company, which has more than 100,000 customers, says it has seen processing volumes increase 1000% in Germany in the past year and 500% in France. 🔎 explore Mollie

Beyond George Suggests

📚 Tink Open Banking Survey report 👉🏻 Read here

📚 Accenture x N26 Global Digital Banking Index 2021 👉🏻 Read here

📚 UX case study: Signing up to Cash App 👉🏻 Read here

🎧 Can banks lead the fight against climate change? Podcast 👉🏻 Listen here

📅 Money Talks: Forecasting Fintech's Big Trends For 2022 👉🏻 Register here

Tweets of the week