In a bold move to revolutionize the financial landscape, the European Parliament has recently unveiled a groundbreaking set of regulations for instant money transfers. These regulations are designed to enhance the speed and security of financial transactions, with a specific focus on eliminating delays for small and medium-sized enterprises (SMEs). Gone are the days of waiting two or three working days to access funds – customers can now rejoice in the immediacy of instant transfers.

Under these new regulations, banks and payment service providers (PSPs) are mandated to ensure the immediate processing of credit transfers, with funds reaching recipients' accounts within a mere 10 seconds, irrespective of the time of day. Furthermore, payers will receive real-time notifications confirming the success or failure of their transactions, adding an extra layer of transparency and security to the process.

These regulations will be enforced uniformly across all EU member states, including those whose currency is not the euro. While a longer transition period will be provided for non-eurozone countries, the ultimate goal remains the same: to facilitate seamless instant transfers for all.

To ensure compliance and safeguard against fraudulent activities, PSPs are prohibited from levying any fees for instant transfers and must implement robust ID verification and fraud detection measures. Additionally, the regulations will be rolled out in two stages, with the eurozone EU countries experiencing a shorter transition period compared to their counterparts in the European Economic Area (EEA).

According to recent research reported by the media outlet Finextra, one-third of EU banks do not currently offer instant payments, and the majority are concerned about meeting the January 2025 deadline. A survey of 200 payment professionals revealed that 58% of banks without instant payment services find the deadlines unrealistic, while a third doubt their ability to meet them. Despite these challenges, 77% of banks believe the benefits of instant payments outweigh the costs, with 55% planning to offer them as the default option.

Despite the apprehension about the tight timelines and the need for significant scaling and investment, one thing is certain – the EU's instant payment revolution is set to transform the way we conduct financial transactions, providing unparalleled convenience and efficiency for businesses and consumers alike.

The Latest

#PRODUCTS #SERVICES

N26 Joint Accounts: Couples Shared Financial Management Made Easy

N26 has introduced Joint Accounts in Germany, facilitating shared financial management for couples. Unlike traditional banking solutions, N26's Joint Account offers added benefits such as being free, quick to create, and providing transaction transparency by allowing to filter expense information by participant. Up to two N26 customers can participate, sharing equal ownership and liability. The account features a dedicated IBAN for managing shared expenses, allowing for automatic payments like bills and rent. To open a Joint Account, users simply navigate through the N26 app and send an invitation to their chosen contact. However, certain features like Spaces and Moneybeam are not initially available for Joint Accounts.

This new offering complements N26's existing Shared Spaces feature, catering to different needs and preferences. While Joint Accounts are available to all N26 customers, Shared Spaces require a premium subscription and offer limited functionality. Joint Accounts are currently available in Germany and will expand to other European markets soon.

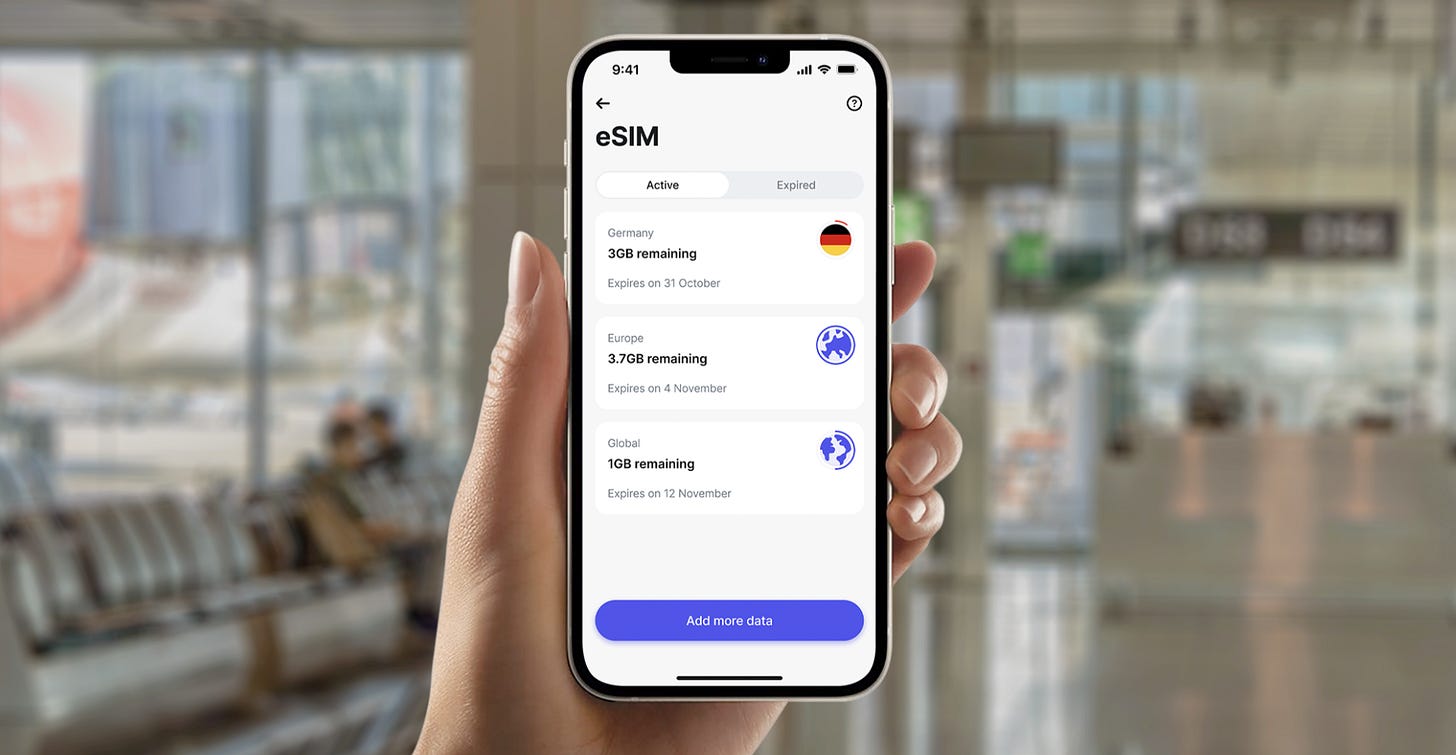

Revolut Introduces eSIM: A Game-Changer for International Travelers

Revolut has pioneered eSIM technology in the European Economic Area (EEA), offering digital SIM cards for seamless data access in over 100 countries, eliminating roaming charges. The eSIM solution addresses the rising costs of mobile data abroad. Some EU mobile networks restrict data usage in Great Britain, making traditional roaming plans less attractive. Ideal for frequent travelers, activating the eSIM through the Revolut app is seamless, with a remarkable user experience. Customers can use the eSIM alongside a physical SIM card, enabling easy network switching without roaming charges. The eSIM also allows access to the Revolut app without consuming mobile data, ensuring uninterrupted use of Revolut's features worldwide. Ultra subscription holders benefit from 3 GB of monthly data for global use. New eSIM activations by May 1, 2024, include a complimentary 100 MB of global data. Pricing for 1 GB data plans starts at €1, with various plans ranging from 1 GB to 20 GB. Customers can opt for regional or global data plans tailored to their needs. Revolut collaborates with TP Global Operations Limited, trading as 1GLOBAL, to offer eSIM Data Plans, enhancing connectivity for its customers across the EEA.

Forget Finance: Empowering Couples in Financial Planning and Investment

Forget Finance, a Berlin-based financial startup, has shifted its focus to become a savings and investment app tailored for couples, while still catering to singles and individual investors.

Couples using the app can set joint savings goals, such as purchasing a home or funding their children's education, and select from a variety of financial products, including money market funds, ETFs, and green investments. Forget Finance collaborates with providers like Evergreen, Vanguard, and Amundi, offering 20 curated investment portfolios with a total annual service fee of 0.59 percent. Notably, there are no transaction costs or hidden stock market spreads, and for investment volumes exceeding €100,000, personalized advice is included.

The app also provides a tax advantage for couples, allowing both partners to benefit from the savings allowance, which grants tax-free profits of €1,000 per person. Unlike traditional joint securities accounts, Forget Finance enables couples, regardless of marital status, to utilize the full savings allowance individually. Each partner maintains their own separate portfolio within the app, ensuring independence in asset management, even in the event of a breakup.

EPI's Wero: A New Era in European Payments

The European Payments Initiative (EPI) announced plans for a common payment system in early 2024, aiming to compete with US giants like Paypal. Sixteen European banks and payment service providers, including BNP Paribas, Deutsche Bank, and Rabobank, are backing the initiative. After years of preparation, the EPI plans to launch its Wero wallet in June 2024 for mobile-to-mobile payments in Germany, Belgium, and France, with further expansion across Europe in the future. Wero will integrate into member banks' apps and operate as a standalone app for Android and iOS, facilitating account-to-account payments based on Instant Payments. Consumers are expected to use Wero for online and in-store purchases by April 2025. The initiative is in discussions with Amazon for retailer partnerships.

Payback and German Savings Banks: Enhanced Partnership for Loyalty Rewards

Payback has partnered with German savings banks to offer Girocards with integrated Payback functions to over 40 million savings bank customers starting in 2025. This collaboration allows customers to earn bonus points when making purchases, even at stores not directly affiliated with Payback. Some retailers will offer One Step Checkout, eliminating the need to present the Payback card during payment. The Payback points overview will be accessible within the savings bank app. Additionally, more than 9,000 partner companies from the savings banks' loyalty program will participate, allowing over 31 million Payback customers to collect points across almost 700 partners in Germany.

#WEALTH

Revolut Introduces Robo-Advisor Service for Automated Investing in the EEA

Recently, Revolut launched its Robo-Advisor service in the EEA. This service offers customers a fully diversified and customized portfolio, investing their money in a range of asset classes including stocks, bonds, and ETFs. The recommended portfolio is tailored to individual risk tolerance and investment objectives, determined during the onboarding process.

The Robo-Advisor evaluates various ETFs to construct the portfolio, considering factors such as costs, liquidity, historical performance, and risk. Typically, customers' funds are invested in 5-8 ETFs, depending on the selected portfolio. The service automatically rebalances portfolios based on asset performance and continually monitors and manages the customer's investments.

With a minimum starting investment of just 100 euros and an annual portfolio management fee of 0.75%, customers can set up recurring transfers from EUR 10 into their portfolio. This product is designed for individuals with limited time or trading experience, offering them an accessible and automated investment solution.

Raisin Transforms ETF Robo-Advisor to Digital Wealth Management

Raisin, the Berlin FinTech, is rebranding its "ETF Robo-Advisor" to "Digital Wealth Management". This new platform offers globally diversified, cost-effective investments in stocks and bonds. Costs are 0.46% annually, plus fund costs of 0.11% - 0.15%, making it more affordable than competitors. Raisin handles withholding taxes and provides annual tax certificates. Existing customers will transition later. The service is suitable for less experienced investors and is currently available in Germany. Raisin Bank manages asset custody, while Upvest provides investment API infrastructure.

Lemon.markets: New Brokerage as a Service Player

Lemon.markets, a FinTech company providing brokerage infrastructure for stock trading, has launched its operational business after obtaining a license from the German regulator in January. Partnering with established entities like BNP Paribas Germany for transactions and Deutsche Bank for deposit storage, Lemon.markets also collaborates with the Tradegate trading platform, offering access to over 8,000 financial instruments.

Their platform, designed with modularity in mind, offers tailored services such as account management, funding, order execution, custody, tax reporting, and a customer portal. Operating as a white-label provider, Lemon.markets offers a "Brokerage as a Service" solution, with Beatvest being one of its initial clients.

Beatvest, a financial education fintech, will utilize Lemon.markets' investment solutions to empower its users to apply financial knowledge directly by investing in ETFs. Lemon.markets competes with companies like Upvest in the brokerage infrastructure space.

Bitpanda Launches Bitpanda Wealth for High-Net-Worth Investors

Bitpanda has recently launched Bitpanda Wealth, a specialized service aimed at catering to the requirements of High Net Worth Individuals, Family Offices, External Asset Managers, and Corporate Treasuries. This offering encompasses a comprehensive suite of services designed to facilitate the investment, management, and reporting needs associated with all crypto-related assets. Bitpanda Wealth is a response to the increasing demand from affluent investors seeking to diversify their portfolios with cryptocurrencies. The service will include over-the-counter trading and high-volume crypto transactions managed by dedicated relationship managers. Additionally, Bitpanda Wealth will offer leverage products, crypto indices, as well as stocks, ETFs, commodities, and metals.

#BUSINESS

Revolut Expands Card Reader Service for Small Businesses to Germany

Revolut has expanded its physical card reader service to Germany, targeting small and medium businesses, freelancers, and casual sellers. By opening a Merchant Account with Revolut Business, customers can connect their business account to the Revolut Reader, which accepts debit/credit cards and contactless payments. Unlike competitors like Square or SumUp, Revolut does not offer a dedicated POS app. Instead, users can manage transactions through the Revolut Business app. Each Revolut Reader costs €49 plus shipping and tax, with no monthly fee. Transaction fees vary but are competitive, with payment speeds under 5 seconds. Developed in collaboration with Jabil Payments, the reader can be adapted to other POS systems. Revolut plans to expand its offering to include a POS software solution in the future. Competitors include Square, Zettle, and SumUp.

Revolut Unveils 'Billpay': Streamlining CFO Functions with AI Integration

Revolut is developing a new product called 'Billpay' targeted at CFOs, aimed at streamlining accounting functions using AI technology. This feature will enable businesses to automatically import invoices from their accounting platforms, extract required information, and process payments with necessary approvals, all within Revolut's business account. Billpay will also integrate with Revolut's existing expense management solution.

AI plays a significant role in Billpay's functionality, such as optimizing receipt matching, identifying unusual transactions, and reducing unnecessary spending. Revolut aims to decrease the time spent on accounts payable by over 80% with Billpay. The company plans to roll out this feature to companies in the second half of 2024, competing with platforms like SAP Concur and fintech firm Ramp.com, as well as other invoice management platforms like Expensify and Bills.com.

Tide Expands to Germany, Following Success in the UK and India

Tide, a business banking platform, is expanding its operations to Germany, marking its second market outside of the UK. With over 575,000 small and medium enterprises (SMEs) already served in the UK, Tide aims to replicate its success in Germany, where potential users are invited to join a waiting list for the Tide app, which will be available in the coming months. Initially, users will access Tide's Business Account and card products, with full platform capabilities gradually introduced, including features like invoicing and cash flow forecasting. This expansion follows Tide's entry into India's SME market in December 2022, where it quickly amassed over 200,000 users. Tide offers various account options, including a free business account and three paid tiers: Tide Plus, Tide Pro, and Tide Cashback. While there are limitations on international transfers and the use of cheques, many users find these restrictions negligible.

#AI #TECH

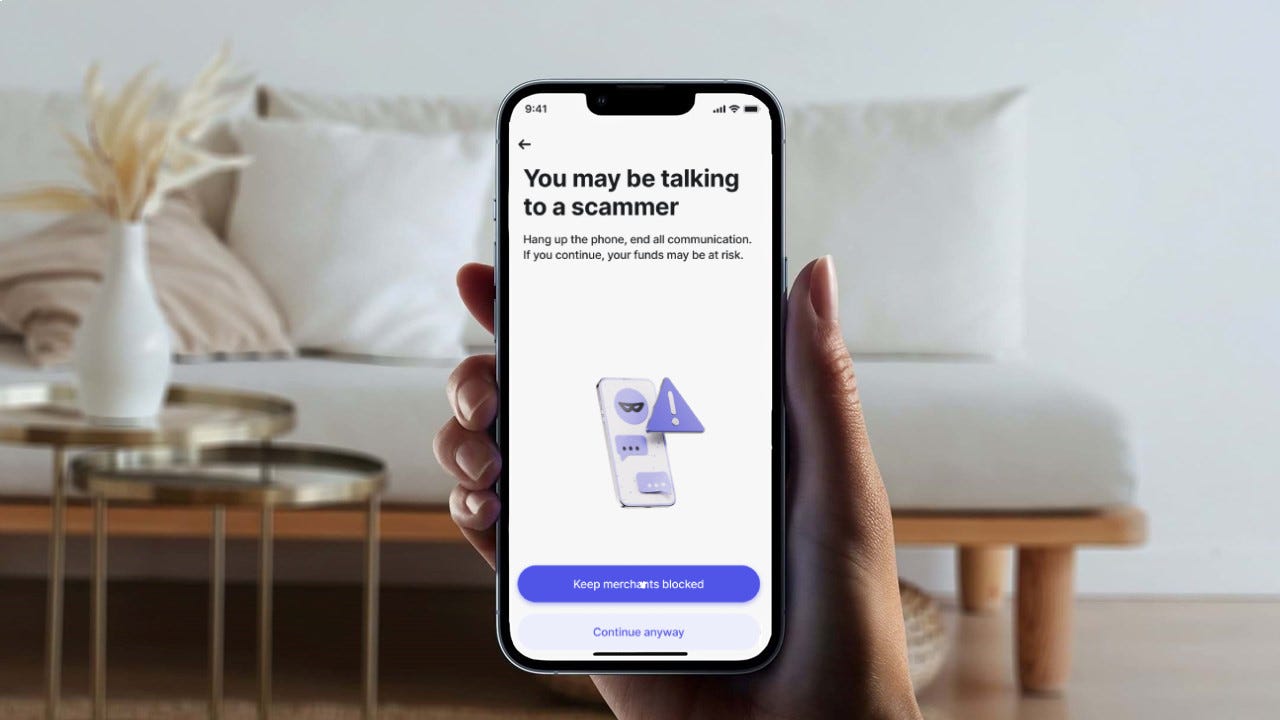

Revolut Launches Advanced Scam Detection Feature

Revolut has introduced an advanced scam detection feature to safeguard customers against card scams, particularly APP scams. This AI-driven feature identifies potential scams during card payments and can decline transactions to protect customers. It guides customers through an in-app intervention flow, providing education on scams and connecting them with fraud specialists if needed. Developed internally, the feature has already reduced fraud losses by 30% in initial testing and is now being rolled out globally. Revolut's data highlights Meta platforms as a major source of scams, with 61% of reported cases originating from these platforms, involving investment and purchase scams.

Mastercard Unveils AI Fraud Detection Model

Mastercard is launching Decision Intelligence Pro, a new generative AI model designed to assist banks in detecting and eliminating fraudulent transactions. Powered by a recurrent neural network developed in-house, this feature enables banks to assess suspicious transactions in real-time and determine their legitimacy. Trained on data from approximately 125 billion transactions annually, the algorithm understands merchant relationships to predict fraudulent activity. Unlike language-based models, Mastercard's algorithm relies on cardholder transaction histories to evaluate merchant authenticity. Using "heat-sensing fraud patterns," it assigns scores based on deviations from typical cardholder behavior, achieving results in just 50 milliseconds. Mastercard claims this technology can improve fraud detection rates by 20% on average, with some instances showing improvements of up to 300%.

Mastercard Pilots Smart Subscriptions: Empowering Consumer Banking Offerings

Mastercard is testing a new subscription management tool for financial institutions, dubbed Smart Subscriptions. This solution empowers consumers to manage their subscriptions by allowing them to cancel, pause, or resume them. Additionally, it aids in analyzing spending, organizing bills, and receiving tailored offers from merchants. Leveraging open banking tech from Mastercard's U.S. arm, Finicity, Smart Subscriptions integrates multiple accounts into a central hub. It's designed for easy implementation via a single API, supports white-labeling, and works with various payment and network options. Currently in a U.S. pilot phase, the rollout to other markets is anticipated later this year.

Klarna Expands "Sign-in With Klarna" Service

Klarna is expanding its "Sign-in With Klarna" service to 22 new countries, initially launched in Sweden. With Apple and Google phasing out third-party cookies, online checkout processes have become more challenging for payment services. Klarna's solution streamlines this process for consumers and merchants, handling data verification internally. This approach not only saves costs for merchants but also enhances user experience. Customers can selectively share data with merchants, enabling personalized recommendations based on purchase history.

CaixaBank's Push for Generative AI Integration

CaixaBank has assembled a specialized task force comprising over 100 experts to explore and implement generative AI across various internal and customer-facing processes. These efforts involve forming multi-disciplinary working groups composed of members from different departments within CaixaBank and its subsidiary, CaixaBank Tech, to develop practical AI use cases. Additionally, strategic collaborations with Microsoft and Accenture have been established to access advanced AI models and expertise. CaixaBank aims to deploy AI solutions across the organization by the end of 2024, focusing on streamlining customer service, risk analysis, and software development.

#SPOTLIGHT-CEE:

🇨🇿 Raiffeisenbank's PlatímPak: Convenient Buy Now Pay Later Service

Raiffeisenbank's PlatímPak service allows customers to defer payment for purchases made in partner e-shops for up to 30 days, with a limit of CZK 25,000. The service offers also an option to split payments into consumer loans if not paid within a month. Raiffeisenbank clients can use the service repeatedly, while non-clients can use it up to ten times a year, totaling CZK 50,000. Despite stagnant online purchases within the market, PlatímPak is growing in popularity, with a 32% increase in volume and 36% increase in deferred payments in 2023. The service is used across various sectors and partners with 13,000 e-shops.

🇨🇿 ČSOB’s Skip Pay: Redefining Payment Solutions

Skip Pay, a subsidiary of ČSOB CZ, offers a cutting-edge mobile app revolutionizing payment services. Users can easily manage transactions and access various features, including activating digital cards, tracking purchases, and managing loyalty points. The app provides flexible payment options like revolving loans and "Pay in 3," allowing users to defer payments and split costs into installments. It simplifies fund transfers, extends warranty and insurance coverage, and offers digital returns and insurance claims. A standout feature is "Top-Up Investments". With Skip Pay, users can allocate a portion of their payments towards investments, with up to 100 CZK invested in portfolios managed by partner company Indigo/Patria Finance. Recent data indicates significant growth in Skip Pay usage, with transactions increasing by 87 percent year-on-year, reaching 1.5 million transactions. Transaction volume also surged to nearly 2 billion crowns, marking an 86 percent increase, while the client base expanded to 450,000 clients, representing a seven percent growth compared to the previous year.

🇸🇰 Ahoj.shopping: The Slovak Klarna

Ahoj.shopping, a subsidiary of the Slovak 365.bank, offers deferred payment services under the "Ahoj" brand to complement traditional and online banking. Customers can choose to pay within 30 days or spread the purchase price over 3 interest-free payments. Microloans up to €300 per month are available, with the initial limit set at €150. Microloans with monthly repayments are available, with credit limits ranging from €20 to €300. A credit check is conducted using data from non-bank registers and Resistant AI, ensuring responsible lending. Data from the annual report 2022 show that Ahoj, a.s. brand, continued the growth of production in 2022, which rose by up to 26% and reached a volume of almost EUR 73 million. While in its main product of consumer loans - ahojsplatky.sk - it achieved year-on-year growth of even 31% and the total production climbed to more than EUR 51 million.

🇷🇴 Banca Transilvania Acquires OTP Bank's Romanian Subsidiaries: A Strategic Move

Banca Transilvania has announced its acquisition of 100% stakes in all subsidiaries operated by Hungarian group OTP Bank in Romania. Pending regulatory approval, the deal encompasses OTP Bank (Romania), a leasing company, and an assets management firm. OTP Bank opted to sell its Romanian subsidiaries due to their failure to achieve critical mass through organic growth or acquisitions. This acquisition marks Banca Transilvania's fourth bank acquisition in almost a decade, following Volksbank Romania, Bancpost, and Idea Bank. OTP Bank (Romania) ranks as the eleventh largest bank in Romania by assets, holding a market share of 2.64% as of September 2023, serving nearly 420,000 retail customers and over 22,000 corporate/SME customers through its 1,800 employees and 96 branches. In contrast, Banca Transilvania leads the market with a 19.91% share and boasts over 4 million customers.