Is OpenAI's 'App Store' Moment An Opportunity For Fintech?

Entering The Second Phase Of Growth With OpenAI's Plugin Feature

Artificial intelligence is rapidly transforming the financial industry, and OpenAI's recent announcement about launching an 'App Store' for AI models has the potential to be a significant opportunity for fintech. The new plugin feature will enable the bot to connect with actionable third-party knowledge to provide more personalized results to customers.

The first wave of plugins has already become available, including services like Expedia, Klarna, Slack, Wolfram, OpenTable, Shopify, and others.

Klarna being one of the first integrated plugins pledges a “highly personalized and intuitive shopping experience” to its users.

By installing the Klarna plugin from ChatGPT's plugin store, consumers will be able to ask for shopping ideas and the chatbot will automatically choose when to use the plugin. So if consumers are looking to buy a new pair of headphones, for example, they can ask ChatGPT for some recommendations within their budget. The chatbot will suggest a few options by linking the products. The recommended links then take users to Klarna's search–and–compare–tool, where they can compare prices and purchase the desired product.

In the midst of financial institutions discussing ChatGPT's impact on the finance sector, developers are exploring the endless potential of the platform. They might be attracted to the opportunity to “chain” their own plugins with others at ChatGPT.

As an example, a ChatGPT user could connect the diet app plugin (to find a healthy recipe idea) to a mathematical plugin (to calculate the amount of each ingredient to purchase) and to Instacart's plugin (to order items).

Could this work with financial services? By linking a real estate plugin, a mortgage calculator plugin, and a banking app plugin, ChatGPT users could get a selection of homes based on their needs and budget, calculate the possible mortgage sum and close the mortgage contract via the bank. Far fetched? We will see.

At the moment users have to access the plugin functionality from the ChatGPT Plus user interface. But according to Fast Company: “In the future, OpenAI may let brands and third-party developers host the plugins at their own sites or apps”.

Nevertheless, we must remain patient. Prior to being made available to other users, the plugin features will first be rolled out to ChatGPT Plus subscribers in Canada and the US.

The Latest:

📍Apple Launches ‘Buy Now, Pay Later’ Service

Apple finally launched it's Pay Later’ service in the US after technical and engineering issues delayed its initial release last year. Apple ‘Pay Later’ allows users to split the cost of a purchase into four equal payments over six weeks without interest or late fees. Selected Apple Pay Users can apply for ‘Pay Later’ within the Wallet app on iOS. Loans, that range from $50 to $1,000, can be used for online and in–app purchases with merchants that accept Apple Pay. Apple isn’t technically offering Apple ‘Pay Later’ itself. The credit assessment and lending are being handled by Apple Financing, a subsidiary of Apple. On the merchant side, Apple ‘Pay Later’ is enabled through Mastercard Installments, with Goldman Sachs serving as the issuer of the Mastercard payment credentials, which are used for Apple ‘Pay Later’ purchases. Read more here 🔗 Apple Press Release

📍Apple Scores With High-yield Savings Account

Apple Card customers are now able to open savings accounts with a competitive offering of a 4.15% annual percentage yield. The savings account is accessible from the Wallet app where customers can oversee the current balance, the current interest rate, and the most recent transactions and manually add or withdraw money. The savings account can be also used for collecting cashback or daily cash rewards. Technically, it is managed by Goldman Sachs. 🔗 Apple Press Release

📍Klarna Kosma Boosts Buddy’s MAU

Buddy, the budgeting app for young people, has partnered up with Klarna Kosma, Klarna’s open banking fintech platform. Through a single API, Kosma offers financial institutions, fintechs and merchants access to 15,000 banks in 27 countries to build apps and services. Through this partnership, Buddy allows users to directly link their incomings and outgoings from their banks. This enables them to track expenses, gain insights into their spending habits, and control their finances in real-time, or set up payment reminders from within the app. Before partnering with Kosma, users manually entered and updated their financial data, which was time-consuming. The partnership has resulted in a 52% increase in Buddy's monthly active users.

📍Acorn’s Europe Touchdown

Micro-investing fintech Acorns has acquired child and teen-focused digital banking startup GoHenry to fuel the European expansion and serve 6 million customers in total. While GoHenry offers a spending card for children aged 6 to 18 linked to a money management app, Acorns focuses on investments letting customers automatically invest spare change from card payments into index funds. Both companies aimed to reach beyond own customer demographics, so that they could serve people throughout their lifecycle, through all life stages. With the acquisition of GoHenry, Acorns hopes to access the less advanced retail investing market in Europe.

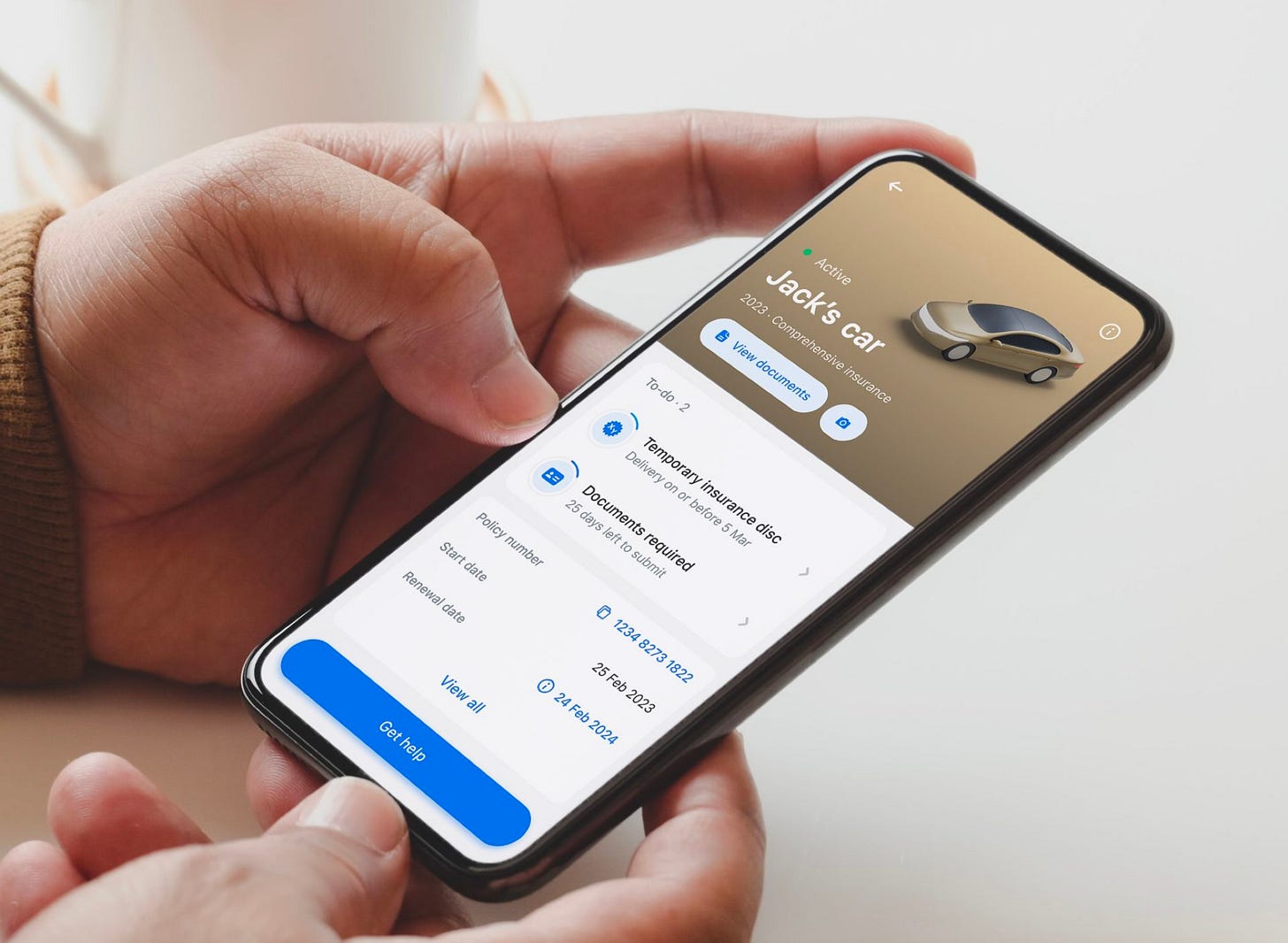

📍Revolut To Enter The Car Insurance Market

Revolut is to launch car insurance for its 2 million Irish customers this spring. The company promises “competitive pricing, flexible product options, a quick and easy user experience and flexible payment options with no hidden fees such as interest rates on monthly payments”. Revolut claims, its insurance will be up to 30% cheaper than the next best provider in the market. Additional discounts of up to 25% will be offered to eligible customers if they enable the ‘Smart Driving’ feature. With ‘Smart Driving’, customers are charged individually based on their driving behavior with a device that plugs into the accessory socket of their car. ‘Smart Driving’ customers should also get lower rates every year. A fully digital onboarding journey of fewer than 5 minutes, which includes getting a quote for those eligible, is several times faster than the market standard. There is, however, no information provided on who is underwriting the insurance.

📍Visa+

Visa has partnered with PayPal and Venmo to test Visa+, a new interoperable peer-to-peer (P2P) payment offering that allows people to transfer money to friends even if they use a different payment service. Visa serves as the infrastructure and connecting glue between the two services. Users need to set up their own unique payment handle that is linked to their PayPal or Venmo account, and then share that handle with whoever they want to be paid by. This means nobody has to share mobile phone numbers, email addresses or other personal details, which may prove itself particularly useful for one-off payments between people who are unlikely to interact again in the future. There are already other companies that have committed to Visa+. they include Western Union, TabaPay, i2C and DailyPay. 🔗 Visit the Visa+ website

📍BloombergGPT: A Large Language Model For Finance

A finance GPT has been sketched out in a research paper released by Bloomberg lately. BloombergGPT does not rely on OpenAI. The company was able to use freely available AI methods. According to this paper, BloombergGPT has been specifically trained on a wide range of financial data. With this model, Bloomberg wants to improve existing financial NLP tasks (natural language processing), such as sentiment analysis, named entity recognition, news classification, and question answering, among others. According to Bloomberg, it’s finance GPT shows promising results doing tasks like: figuring out whether a headline is good or bad for a company’s financial outlook, changing company names to stock tickers, figuring out the important names in a document, and even answering basic business questions like who the CEO of a company is. In contrast, OpenAI’s GPT was trained on terabytes of text, where the vast majority of which had nothing to do with finance. Bloomberg’s approach is different. BloombergGPT was specifically trained on a large number of financial documents, collected by the company over the years, to create a model that’s especially fluent in money and business. While Bloomberg is looking at using AI to power features that could help financial professionals save time and stay on top of the news, they are not planning to release a ChatGPT-style chatbot.

🔗 Read more about BloombergGPT here:

📍Twitter’s Desire To Become A Financial Super App

According to a statement by Elon Musk at a Morgan Stanley conference, Twitter should become “the biggest financial institution in the world.” The first step seems to be a partnership with eToro, a social trading company, that lets Twitter users access stocks, cryptocurrencies and other financial assets. Users will be able to view market charts and buy and sell stocks and other assets from eToro. Currently, it’s already possible to view real-time trading data from TradingView by using Twitter’s “cashtags” feature (you search for a ticker symbol and insert dollar sign in front of it, after which the app will show you price information from TradingView using an API). After viewing real-time price information on their desired stock, by clicking the “view on eToro” button, users will be redirected to eToro’s site, where they can buy and sell assets. Twitter believes that this partnership will enable them to reach new audiences. However, it’s more about finally having some good company news, as Twitter struggled to retain advertisers following Musk's takeover of the company last year.

📍Checkout Moves Into Card Issuing

Fintech startup Checkout.com, better known for its payment processing service, is launching a new product, where its customers can now create payment cards for their own customers. Checkout.com supports physical cards as well as virtual cards that can be used multiple times or can be set to be disabled after the first payment. The new service will be beneficiary to on-demand delivery companies like DoorDash or Uber Eats. These companies rely on cards issued by fintechs like Marqeta, so their delivery partners can buy groceries or food without using their own personal funds.

📍iShare ETFs At Bux Powered By BlackRock

BlackRock has partnered with digital wealth platform Bux to launch ETF savings plans to Bux’s one million users across 8 European countries. The savings plans will be available to investors in the Netherlands, Belgium, Germany, Italy, France, Spain, Austria and Ireland. Following the deal, investors will be able to purchase iShares ETFs via a Bux Saving plan (monthly) with a minimum investment of €10 a month and a €1 commission fee per trade. iShares ETFs include stocks, bonds, themes, factors and sustainable ETFs.

📍Moin JPMorgan?

JPMorgan Chase is working behind the scenes to introduce a digital bank to the German market. According to sources, JPMorgan plans to launch the bank in late 2024 or early 2025 and expand to other European Union markets after that. The hiring in Berlin started, which is expected to be the home base of its consumer operations. The German unit should be the second retail outpost outside the US. JPMorgan is already present in Europe since September 2021 with a digital retail bank in the UK. The UK business is planning on expanding its portfolio by offering credit cards already this year, followed by personal loan offerings.

📍FX Transfer At Low Cost

Atlantic Money finally launched its international money transfer service to more markets, and it’s now live across 29 European countries. What makes the company offering stand out from the competition is that it focuses on a flat fee of €3 per transfer, whether the customer is sending €100 or €500,000. An additional fee of 0.1% of the transfer amount is being charged for express transfers. In addition to new markets, Atlantic Money is also launching its mobile app on Android. The company also plans on launching a web app in the future. When looking at the competition in the market, for smaller transfers, services with variable fees like Wise and Revolut are a cheaper alternative to Atlantic Money. But as soon as consumers want to send more than €1,000, Atlantic Money becomes an interesting choice.

📍Paypal backs Finanzguru

German financial management app Finanzguru has raised € 13m led by PayPal Ventures. The company will use the funding to drive profitable growth in Germany, as well as to further expand its product platform. The company now counts more than 1.5m registered users, with 100,000 clients using its brokerage services and buying financial and insurance products.

📍Klarna Money Talks

Klarna relaunches the ‘Money Talks’ game. Initially released in collaboration with popular podcasters, the card game was made available online with limited edition physical packs available to win. Since its launch the game has been played more than 40,000 times, and consists of three levels and a wildcard round, each touching on different themes like relationships, personal habits and financial basics, to encourage users to have open conversations about money. 🔗 Klarna Money Talks website

📍Curve Pilots Wearables

Curve debuts wearable payments tech with a partnership with wearable payments outfit Digiseq. Curve will offer its 4 million customers across 31 European countries the opportunity to make contactless payments via a range of fashion items, including rings, bracelets and clothing. Digiseq's mobile personalization technology RCOS allows consumers to securely provision their Curve payment account onto their wearable using their Android or iOS smartphone. Users link their card to their wearable item using Digiseq’s white-labeled Manage-Mii app, allowing them to make Curve-powered wearable payments immediately.

Beyond George Suggests

📚 Fintech Future’s Banking Technology Magazine /May 2023 issue 👉🏻 Read here

📚 Tink 2023 report: Banking is getting personal 👉🏻 Read here

📚 Twimbit’s: Global State of Open Finance 2023 report 👉🏻 Read here

📚 INSIGHTS magazine by The Financial Brand /Spring 2023 issue 👉🏻 Read here

📚 Fintech magazine / April 2023 issue 👉🏻 Read here

On a final note:

Thank you for reading Beyond George! Subscribe for free to receive new posts and support our work.

Read also our online magazine Fintech & Banking Innovation on Flipboard. Click the Flipboard logo below for access 👇🏻