Rethinking Resilience in Digital Banking

Monzo Stand-in: Keeping customers connected when it matters most.

As digital banking becomes the norm, outages have emerged as a critical concern for customers, regulators, and financial institutions alike.

Recent data from the UK Treasury Committee paints a concerning picture: nine of the UK’s leading banks and building societies reported a total of 803 hours of outages over the past two years. That’s the equivalent of more than 33 days of interrupted service. One high-profile example was a three-day outage at Barclays that caused 56% of online payments to fail. The bank now expects compensation costs between £5 million and £7.5 million.

The situation isn’t isolated. Other major players, including TSB and HSBC, have also faced significant disruptions, underscoring the vulnerabilities in banking IT infrastructures.

While regulations like the UK’s Operational Resilience regime and the EU’s Digital Operational Resilience Act (DORA) push for improved risk management and incident response, they stop short of prescribing technological solutions.

In response to the increasing demand for operational resilience, digital bank Monzo has introduced a cutting-edge solution: Monzo Stand-in- a fully independent replica banking platform. Running on Google Cloud Platform (GCP), it can immediately take over from Monzo’s primary banking systems, which operate on Amazon Web Services (AWS), in the event of a major incident.

Stand-in enables customers to continue making card payments, withdrawing cash, performing bank transfers, viewing their balances and transactions, and freezing or unfreezing their cards—even if Monzo’s main systems experience downtime. If the main Monzo app becomes unavailable, the app’s background checks detect this and seamlessly switch customers to a simplified, yet fully functional, user interface powered by Stand-in.

Monzo Stand-in had its first major test in August 2024 during a one-hour outage that disrupted payments and app access. The platform was activated shortly after the issue was detected, allowing customers to continue using their money without interruption.

To ensure the platform’s reliability, Monzo adopted a continuous, real-world testing approach. A small, randomly chosen group of customers has periodically used Monzo Stand-in without any disruption to their typical banking experience. This ongoing process allowed Monzo to verify not only the technical integrity of Stand-in but also the consistency of user experience and decision-making compared to the primary platform. In fact, card transactions were processed simultaneously on both platforms to confirm identical outcomes in real time.

Running a backup bank might sound expensive, but Monzo reports that keeping Stand-in operational costs around 1% of the cost of their primary platform. Even during a major outage, activating Stand-in at scale would only increase this cost marginally—a notable success in cost-effective resilience engineering.

Importantly, maintaining this level of resilience may also be key to customer retention. Research by One Poll, commissioned by Roq, indicates that younger banking customers—who are generally more digitally engaged—are also the most likely to switch banks following technical failures. In fact, 57% of 25-34-year-olds and 47% of 18-24-year-olds say they would be very likely or fairly likely to leave their bank in the event of an outage.

This underscores that operational resilience is no longer just a technical or regulatory priority but a crucial factor in sustaining customer loyalty in an increasingly competitive market.

The Latest

#FraudPreventionRevolut Introduces In-App Calls to Fight Fraud

Revolut has launched In-App Calls, a new security feature to prevent impersonation scams and protect customers. Customer support can now initiate secure, app-based calls that fraudsters can’t replicate or intercept.

Most outbound calls from Revolut will now happen exclusively within the app. Customers receiving unexpected phone calls claiming to be from Revolut should verify the contact directly through the app before responding.

After extensive testing, Revolut reports impersonation scams are at their lowest level in nearly two years, even as the customer base has grown to 50 million worldwide. The feature will soon expand to Revolut Business users. Until then, the in-app chat remains the fastest and safest way to seek help.

Starling Bank Launches New Scam Protection Tools

Starling Bank has introduced a Call Status Indicator to verify calls in real-time. Messages like “We’ve never called you” or “You’re on a call with Starling” now appear in the app’s Home and Payment screens, helping users spot fraudulent calls.

The bank also launched the Safe Phrases campaign, encouraging families and friends to agree on secret phrases to confirm identities during suspicious calls. This comes amid a rise in AI voice cloning scams, where fraudsters need just 3 seconds of audio to replicate someone’s voice.

Starling reports that 28% of UK adults have faced AI voice scams in the past year, yet only 30% feel confident spotting them. Nearly 1 in 10 would still send money even if a call seemed suspicious.

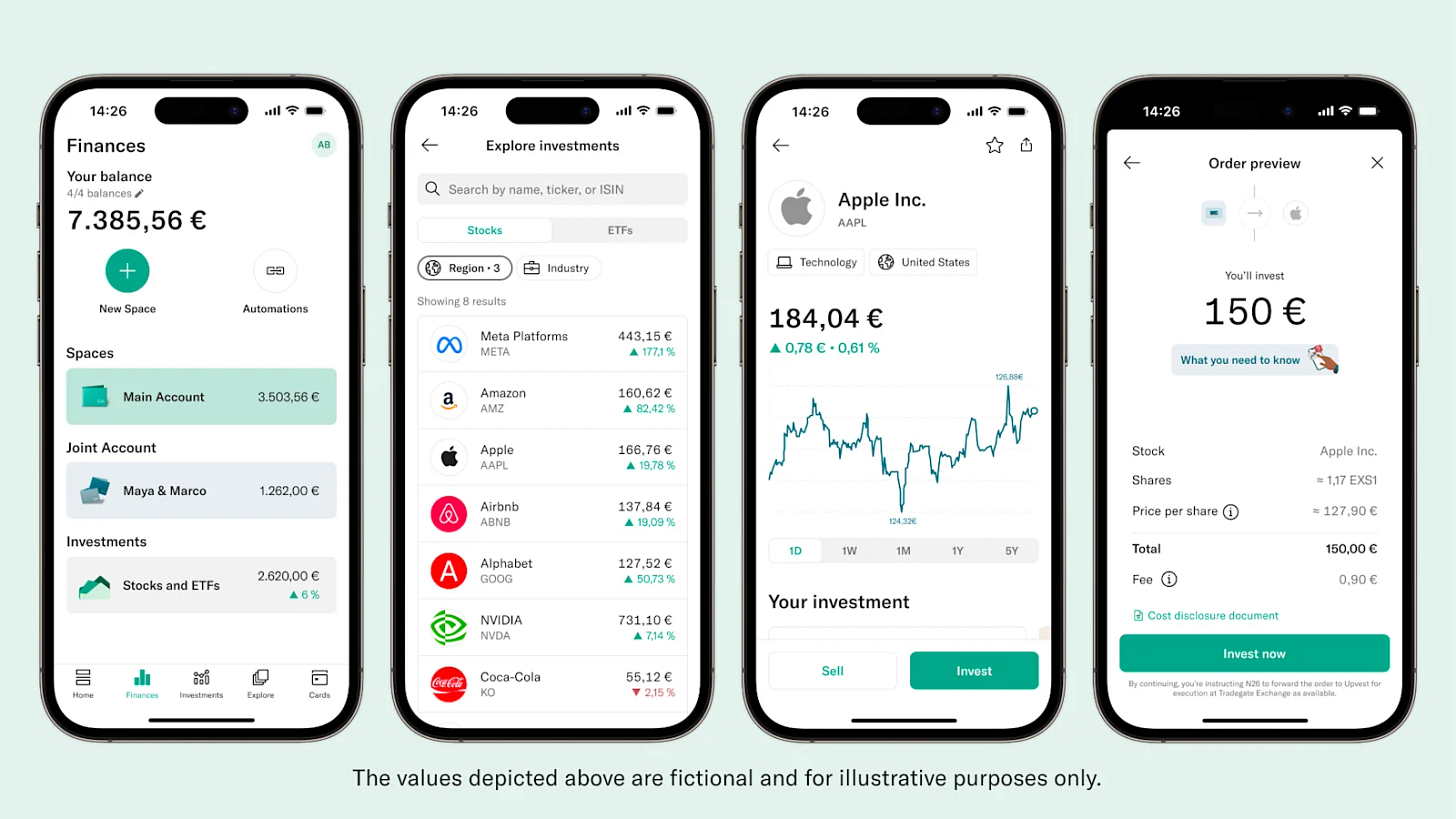

#WealthN26 Offers Free Stock and ETF Trading

N26 customers can now trade stocks and ETFs completely fee-free. The bank has removed all transactions, currency conversion, custody, and inactivity fees. Users can choose from over 2,300 stocks and 1,700 ETFs, with options for recurring investment plans and fractional shares.

Trading takes place via Tradegate, with Upvest and BNP Paribas as broker and depository partners. Crypto trading continues through Bitpanda. Customers should note the service is not tax-friendly, requiring them to manage their tax obligations.

The offering is available in 18 European countries and is part of N26’s push to attract active investors and compete with platforms like Trade Republic.

#BusinessVivid Rolls Out Integrated Business Travel Platform

Vivid Money has introduced a new Integrated Business Travel Platform, offering a seamless solution for booking and managing business trips directly within its app. The platform, designed for freelancers and small businesses, allows users to book hotels, and soon, co-working spaces, train, and flight tickets.

One of the standout features is up to 30% unlimited cashback on hotel bookings, setting it apart from traditional travel platforms that often charge booking fees or require subscriptions. Users can easily view and manage all current, past, and upcoming bookings in one place. The platform also provides real-time expense tracking, automatic categorization of spending, and the ability to upload receipts directly within the app, streamlining the entire travel and bookkeeping process.

This new tool marks a significant step as Vivid transitions fully into business banking, following its exit from the retail banking market earlier this year.

#KidsFamilyBankingMonzo Launches a Bank Account and Debit Card for Kids

Monzo has introduced its long-awaited bank account and prepaid debit card for children aged 6 to 15. Linked to a parent or guardian’s existing Monzo account, the child-friendly version of the main Monzo app offers a simplified experience designed to teach young users how to manage money responsibly.

The account includes no fees for spending, top-ups, or foreign transactions. Children can view their balance and spending activity, use Pots to set savings goals, freeze their cards if lost, and customize the app’s appearance. From the age of 13, Apple Pay and Google Pay become available. All transfers are restricted to parents, and gambling transactions are blocked by default.

Parents can set daily spending limits, control cash withdrawals and online payments, oversee transactions, and add another family member to help manage the account. Up to five accounts can be opened per parent. Funding can be done through one-off payments, regular pocket money, or links shared with family and friends for special occasions.

The account grows with the child, offering seamless upgrades at ages 16 and 18. That said, initial reviews note the absence of the educational features that Monzo previously announced as part of the rollout.

Lunar Unveils Youth Banking App for Kids and Teens

Nordic digital bank Lunar has introduced Lunar Youth, a new banking app tailored for children and teens aged 7 to 17. The app, available in Denmark, Sweden, and Norway, offers a separate, customizable platform where young users can manage their money with a personalized Visa debit card.

Linked to a parent’s account, Lunar Youth provides real-time spending insights, transaction categorization, and tools for setting savings goals. Kids can personalize their app and card design, and make in-store purchases. Online shopping and ATM withdrawals are available with parental approval, while teens over 13 can also use Apple Pay and Google Pay. A budgeting feature will be added by the end of March

Parents receive real-time notifications, can freeze or unfreeze cards, set allowances, and block transactions involving gambling, cryptocurrencies, or adult content. The service is offered as a premium feature for Lunar Plus or Lunar Unlimited subscribers.

Google Wallet Introduces Tap-to-Pay for Kids with Parental Controls

Google Wallet has introduced new parental controls that allow parents to add and manage payment cards for children using Android devices. The feature lets kids make tap-to-pay purchases in stores and manage passes like tickets and gift cards, all under parental supervision.

Children can only add payment cards with parental approval and cannot make online or in-app payments. Parents can monitor transactions via the Family Link app and receive email notifications for every purchase. They can also remove cards or restrict access to passes.

The feature is now available in the U.S., U.K., Australia, Spain, and Poland. This move positions Google alongside competitors like Apple Cash Family and Venmo Teen Accounts, which offer similar parental controls for young users managing digital payments.

Lloyds and Doshi Launch Gamified Financial Education App for Students

Lloyds Bank has partnered with fintech Doshi to launch a white-label financial knowledge app aimed at improving financial literacy among young people. The app features over 150 gamified lessons, an interactive assistant, and AI-powered personalized learning paths covering topics like taxes, credit, investing, and retirement planning.

Users can earn points by completing lessons, quizzes, and challenges, which can be redeemed for rewards like gift cards. The app also allows users to set financial goals and receive tailored guidance through an AI assistant fine-tuned by Doshi.

The pilot phase, running until Q3 2025, targets 100,000 Lloyds student account holders aged 18-24. Participants must sign up with Doshi to access the app. Long-term, Lloyds plans to fully integrate the app into its banking platform.

This collaboration addresses the unmet financial education needs of young users, offering a modern, engaging alternative to outdated offline resources. Doshi, known as the “Duolingo of Money,” already provides financial education solutions to over 15 banks, including TSB and Market Harborough Building Society, and recently launched a pilot with Santander.

#PaymentsMonzo Rolls Out Split for Shared Expenses

Monzo has rolled out Split, a new feature that helps users easily track, split, and manage shared expenses with friends and family. The service is free and works with both Monzo and non-Monzo users, even those outside the UK.

Users can choose between two modes: Single Split for one-off expenses like meals or taxis, and Running Split for recurring costs such as household bills or group trips. The feature automates calculations, sends reminders to settle up, and allows for partial payments. For Plus and Premium subscribers, Split also integrates with connected accounts for easier tracking.

Splits can be personalized with custom names and background images and support expenses in multiple currencies. Participants can join via shared links and manage their contributions through a web interface, making it accessible to anyone regardless of their banking provider.

Monzo’s new feature enters a competitive space alongside services like PayPal’s Pool Money and Tribe Money Pools.

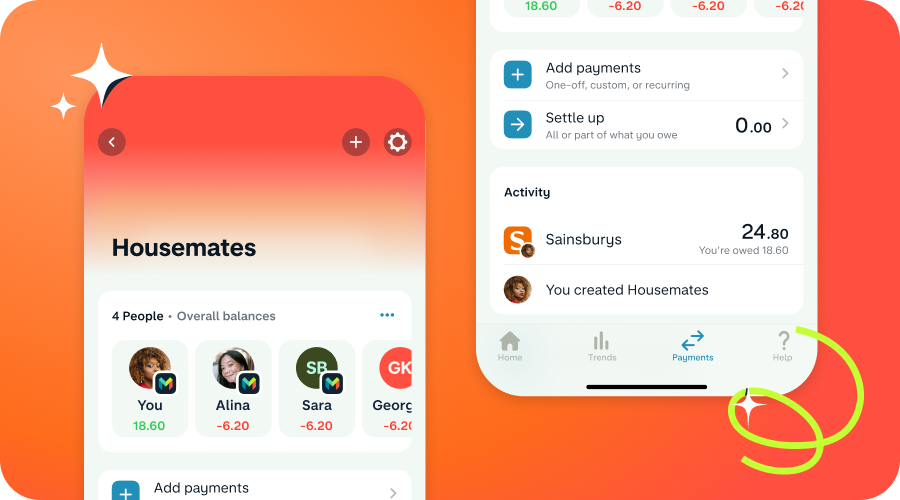

Wise Presents ‘Spend with Others’ for Group Payments

Wise has introduced Spend with Others, a new feature that lets customers set up groups to manage shared spending directly from the Wise app. Designed for families, couples, friends, and housemates, the tool simplifies splitting everyday expenses like groceries, bills, and travel.

The feature is free and allows one group owner and up to four members (or two in Europe). Each participant can add funds, spend from the group balance, and use a digital Wise card for payments. However, only the owner can withdraw or send money and manage group settings.

Unlike joint accounts, the group’s funds remain under the sole ownership of the group creator. Members can belong to up to two groups at once.

Available now in the UK, EU, Switzerland, Australia, New Zealand, and Singapore, the feature supports spending in over 160 countries and 40 currencies. Wise, which serves over 12.2 million personal customers, plans to expand the service globally later in 2025.

Revolut Debuts Credit Card Instalment Plans

Revolut now offers Credit Card Instalment Plans, letting customers repay purchases over €50 in 3, 6, 9, or 12 monthly instalments at 9.5% interest (9.99% APR). Multiple purchases can be combined into one plan, with no setup or early repayment fees.

The feature, available in Spain, Ireland, and Poland, targets users seeking alternatives to ‘pay later’ financing or personal loans. Instalments won’t impact credit limits until fully repaid.

Revolut also plans to launch cashback, pay-later options, and mortgages by 2025.

X Launches Digital Wallet and Payment Service with Visa

X has announced the launch of X Money, a new digital wallet and peer-to-peer payment service developed in partnership with Visa. The service will allow users to transfer funds between traditional bank accounts and their digital wallet, as well as make instant payments similar to Zelle or Venmo.

An early feature will enable creators on X to accept payments and store funds directly on the platform without relying on external institutions. X Money marks X’s first step toward building a financial ecosystem integrated into the platform.

#BankingAsAServiceLunar Spins Off Moonrise to Offer Nordic Banking-as-a-Service

Danish neobank Lunar has launched Moonrise, a new standalone entity built from its Banking-as-a-Service (BaaS) division. Moonrise offers enterprise payment solutions through a single API, streamlining access to Nordic financial services.

The platform provides Nordic payment accounts (safeguarding and corporate) and clearing infrastructure for DKK, SEK, and NOK payments. It already handles over €5 billion in transactions daily and has secured 14 partnerships since 2023, including Saldo Bank, Trustly, TrueLayer, PPRO, and Currencycloud.

Moonrise aims to simplify market entry for international fintechs and banks by offering fast, specialized payment solutions in a region traditionally dominated by legacy institutions.

#RegulatoryCzech Republic Adopts Crypto-Friendly Tax Rules, Eyes Bitcoin Reserves

The Czech Republic has introduced groundbreaking crypto legislation offering major benefits to investors. Under the new law, profits from cryptocurrencies held for more than three years are now tax-free, and transactions up to 100,000 CZK (around €4,000) per year no longer need to be reported to tax authorities.

In a further step towards crypto adoption, the Czech National Bank has proposed recognizing Bitcoin as a reserve currency. The bank’s board has already approved the proposal, signaling a potential shift toward institutional crypto use.

However, the move faces pushback from the European Central Bank (ECB). President Christine Lagarde has firmly opposed allowing Bitcoin in EU central bank reserves.

#CollabsAquisitionsAndMoreRaiffeisen Capital Management Acquires Savity

Raiffeisen Capital Management (RCM) acquired the Austrian robo-advisory platform Savity from Amundi Austria. The move aims to strengthen RCM’s digital asset management capabilities and expand its product offerings.

Savity’s advanced platform, which automates asset management processes, and its experienced team will now support RCM’s growth. Customers will see no changes—portfolios, custodian banks, and access data remain the same.

The acquisition is part of RCM’s broader strategy to drive digital innovation and explore omnichannel integration with Raiffeisen banks. New digital solutions are scheduled for rollout in 2025 to enhance asset management services.

RCM expects the deal to boost both customer growth and assets under management.

Mastercard to Acquire Minna Technologies to Expand Subscription Management Services

Mastercard has agreed to acquire Minna Technologies, a Swedish software firm specializing in subscription management tools. Minna’s technology enables consumers to view and manage all their subscriptions directly within banking apps or a central hub, regardless of the payment method used.

The acquisition supports Mastercard’s broader strategy to diversify beyond credit and debit cards into technology services like cybersecurity, fraud prevention, and pay-by-bank solutions. Mastercard says the deal will enhance its existing initiatives around subscription management, offering consumers a simpler way to track and control recurring payments.

NatWest Invests in AI Platform Serene to Support Vulnerable Customers

NatWest has invested in Serene, an AI-powered platform designed to detect early signs of financial distress and provide proactive, personalized support. The move reflects NatWest’s growing focus on financial inclusion and responsible lending.

Serene combines real-time AI and behavioral science to analyze customer data, identify hidden financial vulnerabilities, and predict future risks. Its key tools—SereneID, SereneVision, and SereneCare—work together to uncover financial challenges, forecast potential issues, and recommend timely interventions.

The platform enables banks to deliver personalized assistance at scale, improving customer care and risk management, particularly in retail banking and consumer credit.

HSBC to Shut Down Zing Money App After One Year

HSBC will close its international money app Zing just a year after its UK launch. The app allows users to hold over 20 currencies, spend in more than 200 countries, and send money in over 30 currencies. Despite these features, Zing struggled to gain traction, attracting only 36,000 downloads in its first two months and 30,000 customers in its first six months.

The closure is part of HSBC’s broader strategy to streamline operations, which has included selling its private banking business in Germany and banking operations in Argentina. The bank plans to integrate Zing’s underlying technology into its core platforms. Customers will be offered the option to transition to HSBC UK’s Global Money service.

Thanks for stopping by Beyond George!

Subscribe for free and keep the good stuff coming.

👓 Read also our online magazine Fintech & Banking Innovation on Flipboard.