Revolut's Bold Move to Shake Up the European Investment Market

Revolut Unveils Standalone Invest App in Czechia Targeting Experienced Investors

Revolut has officially launched Revolut Invest, a standalone wealth management app, with Czechia being one of three pilot markets, alongside Denmark and Greece. While Revolut already offers trading services through its main app, this new platform aims to appeal to a different audience—primarily experienced investors who may not yet be using Revolut’s banking services.

Czechia: A Market with Growth Potential

The Czech market holds significant growth potential for Revolut. As of October 2024, Revolut had around 850,000 users in Czechia, with the company aiming to surpass the 1 million mark by the end of the year. The country’s young investors are key to this growth, with those aged 18-34 already making up 58% of Revolut's investment customer base, just slightly below the European average of 62%. These younger investors, particularly Generation Z, are known for their willingness to take risks, with 20% of those aged 18-24 expressing a strong appetite for higher-risk investments, compared to only 4% of the 55+ age group.

Advanced Features for Pro Traders

Revolut Invest offers access to over 4,000 assets, including U.S. and European stocks, ETFs, commodities, and bonds. The standalone app provides a dedicated platform for CFD trading (Contracts for Difference), a high-risk product that appeals to more experienced traders. This new offering was made possible through Revolut's partnership with CMC Connect, which provides essential trading, execution, and clearing services.

Customers will also have access to Revolut’s Robo-Advisor, which offers automated investment management for a fee of around 0.75%. For those seeking even more advanced features, Revolut offers Trading Pro, a premium subscription service that provides discounted fees, advanced analytics, and higher trading limits for a monthly fee of €15.

While the Revolut Invest app is designed to cater to both new and existing customers, it offers only limited access to Revolut Bank’s full suite of services. Users can make transfers between their Revolut investment and main accounts, access limited currency exchange services, and view account balances, but they won’t have full access to Revolut’s traditional banking features within the Invest app.

Changing Investment Trends in Czechia

The launch of Revolut Invest comes at a time when investment trends in Czechia are evolving, especially among younger generations. Data from a survey shows that 54% of investment portfolios of Czechs aged 18-34 consist of money market funds, largely driven by Revolut's FlexiFunds, a flexible savings product introduced in July 2023. Stocks make up 27%, ETFs account for 12%, and bonds for 8% of their investment portfolios. These insights highlight the growing diversification in the portfolios of younger investors, who prioritize low fees and transparent pricing when selecting investment platforms.

In terms of the most-traded assets, Nvidia was the most popular U.S. stock traded by young Czech investors in July 2024, while the Vanguard S&P 500 ETF was both the most bought and sold ETF. Within the European stock market, Rheinmetall AG was the most sold stock, while Mercedes-Benz Group AG topped the charts for the most bought shares.

A Growing Global Investment Powerhouse

With over 3 million users already engaged in its investment services globally, and assets under management having tripled to €8.5 billion in just a year, Revolut is positioning itself as a formidable player in the wealth management space. The introduction of the Revolut Invest app places the company in direct competition with established platforms like Robinhood, eToro, Trading 212, and Freetrade.

As Revolut monitors the app’s performance in Czechia and other pilot markets, the company plans to refine its offering and consider a wider European rollout later this year.

(Data source: Revolut, Dynata, Bloomberg, Fintree)

The Latest

# PRODUCTS # SERVICES

Bunq Launches ‘Stocks’ for Digital Nomads

Bunq has entered the European stock trading market with Bunq Stocks, a new product tailored for digital nomads. With 14.5 million users, Bunq aims to simplify investing by offering access to popular U.S. and European companies, as well as global ETFs. The service is free for the first three months, after which a 0.99% fee per trade applies, with discounts for premium users. Investments start at €10. Partnerships with Upvest and Ginmon enable fractional trading and investment management. Bunq expects the platform's simple language and user-friendly design to attract new investors and drive customer growth. Initially available in the Netherlands and France, Bunq plans to expand Stocks across Europe.

Bunq Rolls Out a Range of Exciting New Features: AI-Powered Finn, eSIM, and Travel Insurance

Bunq has rolled out a series of exciting new features aimed at enhancing user experience.

AI assistant, Finn now supports conversational interactions, answering back-to-back questions and providing deeper financial insights. Finn has also become a key tool for customer support, solving up to 40% of user queries independently.

Finn now offers also personalized budgeting advice, tracks spending, and provides daily financial tips within the Budgeting tab. Users in the Netherlands, Germany, and France can also link external bank accounts for a comprehensive financial overview, thanks to Bunq’s latest partnership with Mastercard. Powered by the Mastercard Open Banking Platform, Finn can now retrieve and analyze transactions from external banks, offering insights like detailed travel expense reports. Nearly 40% of surveyed users reported increased app engagement following the feature's launch.

Within the Travel tab, Finn offers personalized recommendations for dining and entertainment, based on input from users and friends.

Frequent travelers will benefit from Bunq’s new eSIM feature, offering up to 90% savings on roaming fees in over 160 countries. The service is provided through a partnership with BetterRoaming.

Bunq is also expanding into Travel Insurance, offering worldwide free coverage to premium users. The new insurance covers car rentals, dental emergencies, and personal item losses up to €1 million. Family members, including partners and children, are automatically covered, though the service is currently limited to residents of selected European countries. Insurance claims can be filed directly within the app, thanks to Bunq’s partnership with Qover.

Monzo Unveils Pension Consolidation for Easy Retirement Planning

Monzo has introduced a new pension consolidation product, designed to help customers combine their old pensions into a single Monzo Pension. This new feature simplifies pension management by allowing users to provide basic details and former employer names, after which Monzo handles the rest. In partnership with pension-finding specialist Raindrop, Monzo tracks down and consolidates old pensions into one Self-Invested Personal Pension (SIPP).

The Monzo Pension will be invested in a target date fund managed by BlackRock. These funds automatically adjust risk levels over time, based on the customer’s intended retirement age. Customers will be charged an annual fee of 0.63% based on the value of their investment.

Trade Republic Expands into Neobanking with New Checking Accounts

Trade Republic is gradually transitioning from a neobroker to a neobank, with the introduction of checking accounts. Customers can now transfer money to third parties, set up standing orders, and receive real-time transfers from other banks. Each user is assigned a Trade Republic IBAN, with deposits held by major banks like Deutsche Bank, JP Morgan, and HSBC.

As an added incentive, Trade Republic offers a 3.5% interest rate on all cash deposits, with no limit, removing the previous €50,000 cap per user. The checking account is being rolled out in stages, starting in Germany and expanding to other markets in the upcoming months.

While Trade Republic’s current account features are considered "standard" compared to the free offerings from neobanks like N26, Revolut, and Vivid, market experts believe that premium accounts could soon follow. Potential premium offerings might include bundled services like insurance, robo-advisors, or joint accounts, signaling Trade Republic's ambitions in the neobank space.

Klarna Launches Balance Accounts and Cashback Rewards in Europe

Klarna has expanded its product offering in Germany, Austria, and 10 other markets, introducing Klarna Balance. This new feature allows users to store money in their Klarna account, add funds from their bank accounts, earn cashback rewards from shopping through the Klarna app, and manage refunds from returns. Klarna Balance is fee-free, with no monthly charges.

Klarna’s new Cashback feature rewards users with up to 10% cashback on purchases from over 100 online shops, which is credited to their Klarna account.

Klarna's interest rates (flex 3% or fixed 3.35%) are competitive, comparable to N26 (up to 3%) and Trade Republic (3.5%), while its cashback offers a more attractive option than Trade Republic’s 1% saveback.

Hungary Introduces Qvik: Instant QR Payments for Faster Transactions 🇭🇺

On September 1, 2024, Hungary introduced Qvik, a new QR code instant payment solution, following regulations from the national bank (MNB) and developments in the Instant Payment System. Qvik aims to provide faster and more affordable transactions, particularly for small and medium-sized businesses (SMEs).

Developed in cooperation with MNB and GIRO, Qvik offers an alternative to traditional card payments, allowing all bank customers to pay by scanning a QR code both in-store and online. Unlike card payments, which can take 1-4 days to settle, Qvik ensures immediate access to funds for merchants.

Wero Launches Instant P2P Payments, Eyes Retail and BNPL Expansion

In early July, Wero, the payment solution of the European Payments Initiative, was quietly launched via a press release. Its first feature allows person-to-person (P2P) transactions, enabling users to send and receive money in under 10 seconds using a phone number, email, or QR code. A separate wallet app is expected to be launched soon.

A pilot program with retailers is set for the fourth quarter of 2024. By next year, Wero will support payments for SMEs, and online merchants via QR codes, and recurring payments. In 2026, it plans to expand to include in-store payments, expense sharing, and buy now, pay later (BNPL) options.

Monzo Brings Buy Now, Pay Later to Apple Pay

Monzo has become the first UK bank to introduce Buy Now, Pay Later (BNPL) functionality via Apple Pay. Monzo Flex credit card users with iOS 18 can now split payments over several months directly at checkout. Customers can add their Monzo Flex card to Apple Wallet, and then select "Pay in Full" or "Pay Later" when using Apple Pay at checkout. Monzo's move sets a new standard in the UK banking industry, with other banks expected to follow suit.

Apple Agrees to Open iPhone NFC to Third-Party Apps in the EU 🇪🇺

The European Commission has accepted Apple’s commitments to open access to the iPhone’s NFC chips, allowing third-party apps to use tap-to-pay functionality. This agreement, which will be in place for 10 years, applies to all third-party mobile app developers and iOS users within the European Economic Area (EEA).

Apple will enable mobile wallet and payment service providers to access NFC features through APIs, free of charge, without needing to use Apple Pay or Apple Wallet. Additionally, Apple will develop APIs for secure transactions in Host Card Emulation (HCE) mode, bypassing the device’s secure element. To ensure fairness, Apple will also implement a monitoring system and a separate dispute resolution process to review decisions that restrict access.

# FRAUD PROTECTION

Monzo Unveils New Anti-Fraud Features for Enhanced Security

Monzo has introduced three new anti-fraud features—Known Locations, Trusted Contacts, and Secret QR Codes—to help protect customers from scams like phone theft and impersonation. These opt-in features require users to set up at least two controls and choose limits for when each feature is activated during bank transfers or savings withdrawals.

With Known Locations, customers set specific places, like home or work, where they must be when making transfers above a chosen limit. If they are outside these locations, the transaction won’t go through. Trusted Contacts allows users to invite a trusted Monzo user to verify large transactions before they proceed, offering extra protection, especially for vulnerable users. Secret QR Codes, stored on another device, are required alongside the user’s phone for transactions above the set limit.

These new features follow Monzo’s Call Status tool, launched in September 2023, which helps users verify if they are speaking with Monzo during a call. So far, the tool has assisted in reporting over 4,000 fraud attempts this year.

OTP Bank Adds New Security Feature to Combat Phone Fraud 🇭🇺

In August, OTP Bank introduced a new security feature in its OTP MobilBank app to help prevent telephone fraud. Customers can now verify whether they are truly speaking with a bank advisor by using the app's "Profile" section, where details such as the time of the call, phone number, and customer service ID are displayed.

This new feature allows customers to ask for a customer service ID during the call, helping them determine whether the call is legitimate or from a potential scammer. The app also logs all bank calls, including missed ones, for later verification, providing an extra layer of security against fraud.

Revolut Shields Customer Savings with New Wealth Protection Feature

Revolut has introduced a new security feature called Wealth Protection to safeguard customer savings from theft. This extra layer of identity verification helps prevent criminals from accessing accounts, even if a customer's phone is stolen or their password and face recognition are compromised.

When activated, Wealth Protection verifies the user’s identity against the original selfie ID submitted during account setup. The feature is opt-in and can be enabled specifically for savings accounts.

Revolut was among the first to roll out this added security measure, and was doing so ahead of the busy summer travel and festival season when the risk of theft in crowded areas was higher.

# AI # WEALTH

Bitpanda Introduces AI Coach for Smarter Financial Management

In mid-May, Bitpanda announced a significant €9.2 million investment in artificial intelligence, marking the launch of its new division, Bitpanda.ai. Now, the company has revealed its first AI-powered financial research tool, known as the AI Coach. Currently in its experimental phase, the AI Coach is available to a selected group of users on the web platform.

The AI Coach is designed to assist users in making informed financial decisions and better understanding their risk exposure. While it doesn’t provide direct investment recommendations, it offers portfolio analysis, insights into asset allocation, and market updates on the cryptocurrencies within users' portfolios. Additionally, the AI Coach encourages users to set up savings plans, helping them stay on track to achieve their financial goals.

Built on ChatGPT, the AI Coach delivers dynamic, personalized responses to user queries and provides educational content aimed at improving financial literacy. Bitpanda envisions the AI Coach as a tool that not only helps users manage their portfolios but also periodically offers new insights and strategies for financial growth, guiding users toward smarter investment decisions.

Lunar Trials AI Chatbot to Enhance Financial Wellbeing and Customer Support

Nordic challenger bank Lunar is testing a new AI-powered chatbot, Lunar AI, designed to assist users with their financial wellbeing. Integrated into the bank’s mobile app, Lunar AI helps with tasks such as tracking spending, generating customized expense reports, and resetting PIN codes. While it doesn't provide financial advice, the chatbot answers general financial inquiries and helps users manage their finances more effectively.

Powered by OpenAI’s GPT technology, Lunar AI is being trialed internally, with plans for a full rollout to customers soon. A voice-activated version is also in development, enabling users to interact verbally.

Initially, the bank developed LunarGPT, an internal version of ChatGPT, to assist its 450 staff members with questions about Lunar products and internal resources. Following this, the tech team created LunarMind, an AI-powered customer service chatbot designed to help support agents respond to customer queries more efficiently.

# BUSINESS

Revolut Aims To Simplify Bill Management for Businesses with BillPay

Revolut has officially introduced BillPay, a feature designed to streamline bill management for businesses. BillPay integrates with accounting software such as Xero, FreeAgent, and QuickBooks Online, allowing companies to automatically import and manage bills and invoices.

Powered by AI and Optical Character Recognition (OCR) technology, BillPay automates tasks such as data extraction, matching receipts to transactions, detecting unusual bills, and suggesting ways to cut unnecessary spending. It also syncs accounting details, tax rates, and supplier information while managing workflows and approvals. With BillPay, businesses can be saving over three hours per week for finance teams by reducing manual effort and errors.

Hungary's First B2B Neobank: BinX 🇭🇺

The founders of Számlázz.hu, a popular invoicing platform, have launched BinX, Hungary’s first domestic B2B neobank, aimed at creating a digital, integrated payment infrastructure within the Számlázz. hu ecosystem. The service is available to companies and individual entrepreneurs registered in Hungary.

Key features include online account opening, free transfers within the BinX network, and a fixed fee of HUF 199 for domestic transfers outside the network. Currently, BinX does not support foreign currency or international HUF transfers. The service is integrated with Számlázz. hu, enabling streamlined account management and automated bill payments.

BinX accounts are accessible via a mobile and web app, offering a traditional bank account number for transactions. Soon, users will also have access to Mastercard premium virtual and physical bank cards.

# Kids Banking

Monzo to Launch Free Accounts for Children Under 16

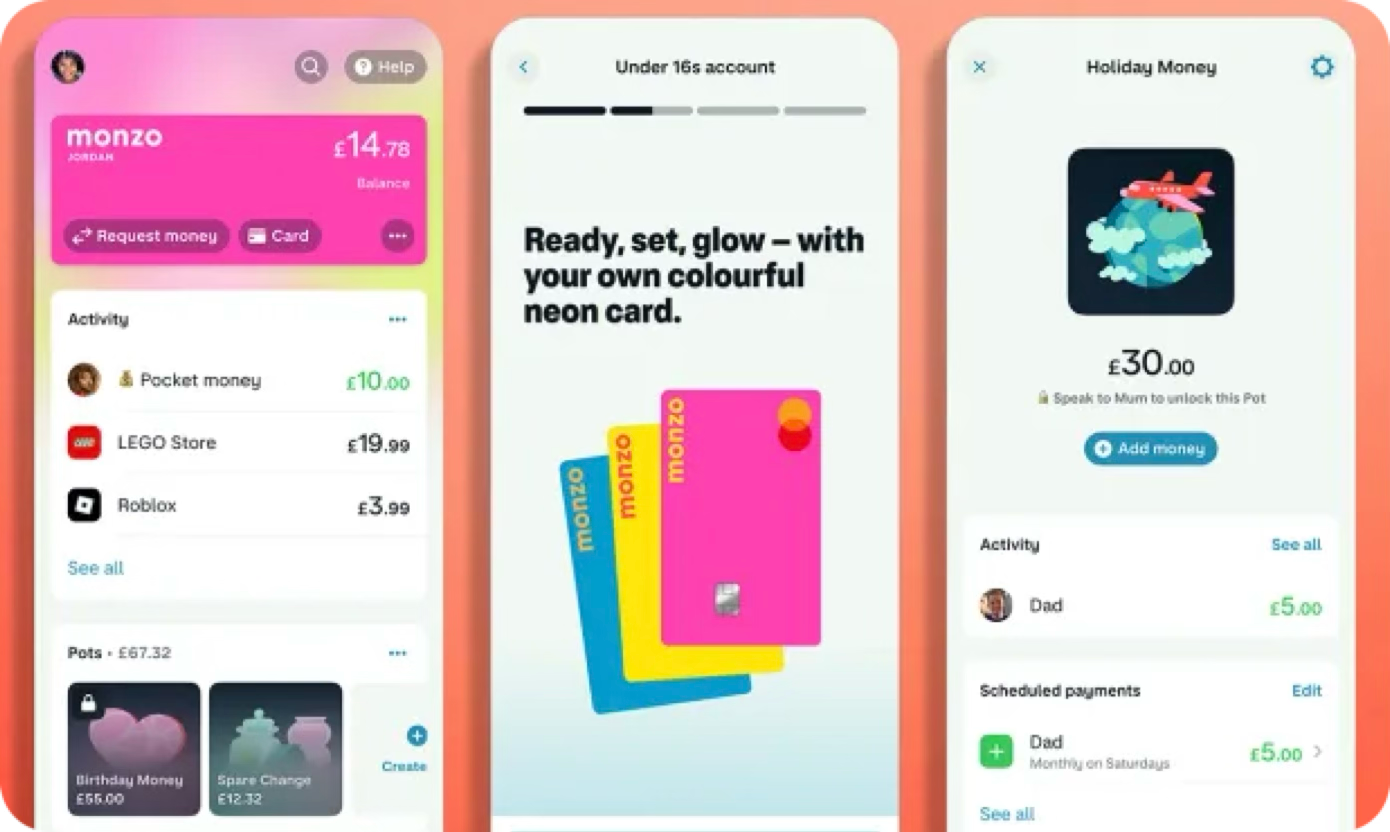

Monzo is preparing to introduce a free account for children under 16, with a waitlist already available. Kids with their own devices will be able to access a child-friendly version of the Monzo app.

The account offers familiar Monzo features, including no fees for top-ups, subscriptions, or spending abroad. Children can set savings goals, receive scheduled pocket money, and have their accounts linked to their parents’ accounts for oversight. Parents can monitor transactions, receive notifications, set spending limits, and control online payments and cash withdrawals.

The launch follows extensive research, with Monzo conducting 12 rounds of research, interviewing 1,200 families, and gathering 4,440 minutes of testing feedback. The project, which began in June 2023, aims to improve money management for children.

Tatra Banka Goes the Extra Mile with New App to Elevate Kids' Financial Literacy 🇸🇰

Tatra Banka has developed a new app called TABI for children under 15, aiming to address the low penetration of child bank accounts (below 15%) and improve financial literacy in Slovakia. The app is divided into two sections: Banking and Educational.

The Banking Section uses real account data and can be activated by parents with Tatra Banka child accounts. Children can track their balance, request pocket money, categorize expenses, and set savings goals. Parental controls allow oversight of spending and online payments.

The Educational Section, open to everyone, features 30 learning units across 6 chapters, teaching financial concepts through stories and interactive quizzes. Kids earn virtual coins and badges, which can be used to upgrade their in-app character, TABI, a digital creature designed to make learning about money fun.

This innovative app was developed with input from game designers, psychologists, and financial experts, and was tested by over 650 children.

📩 Thank you for reading Beyond George!

Subscribe for free to receive new posts and support our work.

👓 Read also our online magazine Fintech & Banking Innovation on Flipboard.