Shaping Finances: Trends for 2024

Insights into the Key Developments Influencing Financial Services

Since the end of 2023, experts have been looking into potential trends that will shape and influence financial services in 2024. Below, we present a compilation of the most noteworthy ones.

A2A Payments

Emerging as one of the most transformative trends in 2024 is the rise of account-to-account (A2A) payments. A2A payments bypass intermediaries such as card networks, facilitating direct transactions between accounts, often leading to instant transfers.

In 2022, A2A payments accounted for 9 percent of global e-commerce payment transactions, surpassing Buy Now, Pay Later (BNPL) due to its longer existence.

Multiple factors point toward A2A payments gaining significant traction in 2024. Firstly, the rise of Open Banking enables secure access to individuals' bank accounts for authorized third-party services. Additionally, the rapid expansion of instant payment systems across numerous countries provides swift, cost-effective, and easily reconciled transactions. Furthermore, there's a growing resistance to the dominance of card networks, particularly those owned by American businesses. This resistance is prompting an exploration of alternative payment methods, especially in Europe.

Merchants are most likely to favor A2A payments for their lower acceptance costs compared to cards, encouraging them to streamline checkout processes. Additionally, instant payments offer a faster settlement, granting merchants swift access to funds. Moreover, bank payments via Open Banking, verified through mobile banking apps, help reduce fraud rates.

A2A payment methods such as Pix in Brazil, iDEAL in the Netherlands, and BLIK in Poland are dominant in their respective markets. Embedded within legacy payment systems like giropay in Germany or offered as standalone A2A tools by private fintech companies such as Trustly, Sofort, and Volt, the accelerated adoption of A2A payments provides seamless payment experiences in mobile apps, online checkouts, and POS terminals.

GenAI

Generative AI, including ChatGPT, offers depending on the specific use case, various benefits such as accelerated product development, enhanced customer experience, and improved employee productivity. The phenomenon of ChatGPT has sparked experimentation across different sectors. However, linking the rise of generative AI to tangible use cases with clear benefits has proven challenging for them.

A Gartner webinar poll, involving over 2,500 executives, identified customer experience and retention (38%) as the primary focus of their generative AI investments. This was followed by revenue growth (26%), cost optimization (17%), and business continuity (7%). (Gartner, May 2023)

Experts predict that in 2024 generative AI will disrupt the banking sector due to its extensive capabilities. The banking sector possesses a vast amount of data, which serves as the fuel for generative AI. This data includes transaction behavior, account balances, spending categories, and more, offering opportunities for generative AI to create valuable content that enhances customer relationships. Additionally, traditional banks face stiff competition from digital-only banking brands like N26, Monzo, and Revolut, which excel in providing compelling user experiences and insightful spending habits analysis.

To remain competitive, banks are focusing on improving user experience, a challenge they've historically struggled with due to siloed data. However, as banks transition their operations to the cloud, siloed data becomes less of a hindrance, enabling the effective use of generative AI and other tools. In 2024, experts anticipate generative AI disrupting spending insights by offering personalized recommendations based on user spending habits and other data, thereby enhancing the user experience.

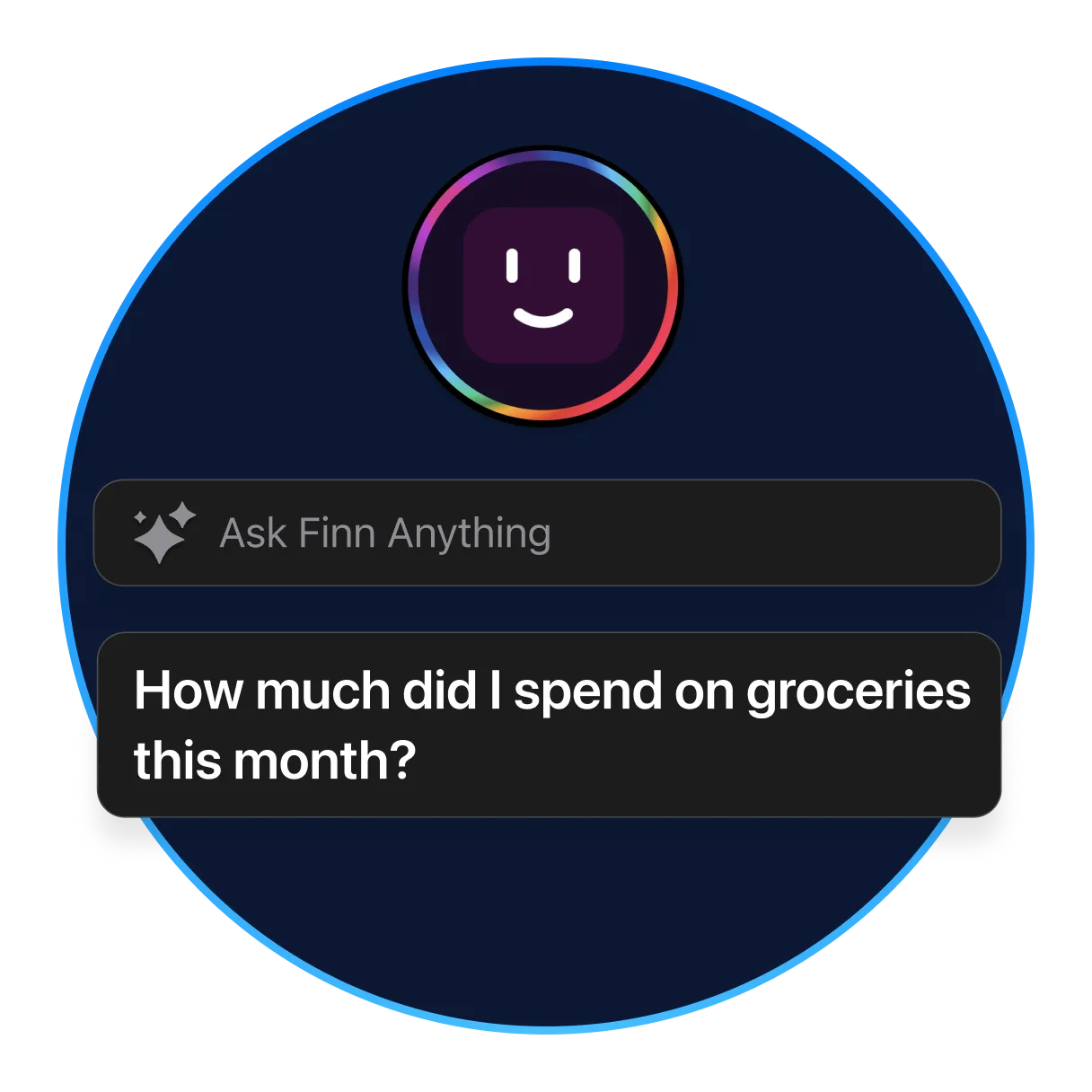

The first European challenger bank to integrate genAi into its platform is bunq, which introduced ‘Finn’ at the end of 2023. (For more information about Finn, please refer to the 'The Latest' section below.)

While major banks are expected to adopt generative AI technology in 2024, they'll also need to navigate potential regulatory challenges associated with its use in highly regulated sectors.

Digital ID

In June 2021, the European Commission introduced a proposal to revise the existing eIDAS (Electronic Identification and Trust Services) regulation, referred to as eIDAS2.

This proposal introduces the concept of a European Digital Identity, designed to provide EU citizens, residents, and businesses with a unified way for authentication and personal information verification purposes across online and offline, public and private services, throughout the EU.

In the future, member states will offer digital wallets, which can be provided by either public authorities or the private sector, enabling users to consolidate various aspects of their national digital identities. The EU ID Wallet will allow users to store identity data, credentials, and attributes while regulating cross-border electronic identifications and unique identifiers. Consumers will gain control over the data they share, accessing services online without relying on private platforms or unnecessarily disclosing personal information.

A consortium, named ‘Potential’, responsible for piloting the initiative, aims to address six priority use cases, including eGov Services, Bank Account Opening, SIM Card Registration, Mobile Driving Licence, Qualified eSignature, and ePrescription, aligning with citizens' needs in Europe.

Building on the success of GDPR, eIDAS2 is poised to influence digital identity regulation globally, driving the adoption of wallet-based solutions. This trend is already evident with Apple's integration of digital driving licenses into its Wallet app in the US, with other digital wallet services likely to follow suit. In 2024, the focus is expected to shift towards developing solutions based on digital ID wallets, leading to accelerated adoption across various regions. Experts predict that mobile money apps will become vital for storing identity credentials.

CBDCs

2023 marked the year of Central Bank Digital Currencies (CBDCs) taking center stage on regulators' agendas worldwide and featuring prominently in numerous position papers and practical trials. These digital currencies, representing fiat money (e.g. Euro, US dollar, etc.) in purely digital form, offer instant clearing and settlement, distinguishing them from traditional digital payments. Moreover, CBDCs can be tailored with programmable features, allowing for specific usage purposes, such as government payouts for essential needs like food, gas, or rent. However, their programmable nature raises concerns about potential government control and surveillance, sparking a global debate over their true value and implications for citizen privacy.

In October 2023, China's use of digital yuan in a cross-border oil trade marked a milestone. This coincided with the European Central Bank initiating the preparatory phase for its CBDC project, Swift beta testing a CBDC connector, and numerous other nations exploring CBDC initiatives. Meanwhile, international organizations like the IMF and BIS are studying their broader implications.

Looking ahead to 2024, CBDCs are anticipated to experience substantial market growth, especially in applications such as cross-border payments and B2B transactions. Private sector entities in finance and technology are exploring their potential roles within the CBDC ecosystem, whether through the development of digital wallets or platforms to facilitate CBDC transactions.

ESG

In 2023, increased environmental and social concerns, including the climate crisis and the cost-of-living crisis, underscored the growing significance of ESG (Environmental, Social, and Governance) compliance in the banking sector. This trend was driven by increasing customer demand for sustainable and inclusive financial solutions. Accessibility has emerged as a key component of ESG compliance, with the European Accessibility Act mandating banking services' accessibility by June 28, 2025, aiming to enhance inclusivity for people with disabilities and older individuals.

Additionally, a 2022 report revealed that 46% of Germans view ESG criteria as a significant investment factor, with 28% willing to utilize their bank's services to assess the carbon footprint of their purchases, reflecting a broader trend observed across Europe and the USA.

Banks are presently exploring ESG compliance with undefined regulatory requirements, but in 2024, Juniper Research predicts banks will adopt coordinated ESG strategies.

Stablecoins

Stablecoins, cryptocurrencies tied to traditional currencies like the U.S. dollar to mitigate volatility, have garnered both positive and negative attention in recent years. However, in the new year, a significant shift is anticipated as stablecoins are projected to integrate with consumer platforms, potentially leading to substantial growth by expanding their accessibility beyond the realm of traditional crypto investors. Major payment firms like PayPal are already exploring their own stablecoins, while industry giants like Deutsche Bank and JPMorgan Chase have also entered the stablecoin market, with Deutsche Bank expected to launch its stablecoin soon.

B2B BNPL

The rise of embedding financial services into non-financial platforms is poised for rapid growth. Despite many banks exploring embedded finance, a study by the Boston Consulting Group reveals that only 27% of leading banks are significantly involved in collaborative ecosystems, with most still in experimental phases.

Within embedded finance, embedded lending is anticipated to experience the most significant surge. Since the pandemic businesses have faced challenges due to high inflation and interest rates, particularly impacting SMEs with limited access to financial tools. This has led to an underdeveloped SME finance market, creating a significant opportunity for growth. In 2024, Buy Now, Pay Later (BNPL) services are expected to fill this gap, offering flexible credit options to smaller businesses as the direct-to-consumer BNPL model saturates key markets. Consequently, there is expected to be a notable expansion of B2B BNPL offerings targeting the SME market in 2024.

The Latest

Bitpanda Products Now Available in RLB NÖ-Wien's ELBA App

Customers of Raiffeisenlandesbank (RLB) NÖ-Wien now have access to Bitpanda products via their online banking app ELBA, offering cryptocurrencies, precious metals, raw materials, stocks, and ETFs starting at 1 euro. Bitpanda owns the crypto wallets and traded assets, with the white-label solution catering to both novice and experienced traders. The onboarding process consists of four steps and reportedly takes 30 seconds to 1 minute according to initial Twitter reviews. However, certain limitations apply, such as the inability to transfer crypto assets from other wallets to the "My Elba app," with no options for sending cryptos or staking in the basic package. The project took 10 months to complete. Despite the popularity of cryptocurrencies in Austria, banks typically approach crypto investments cautiously due to money laundering risks, resulting in a closed system for this offering. 🔗

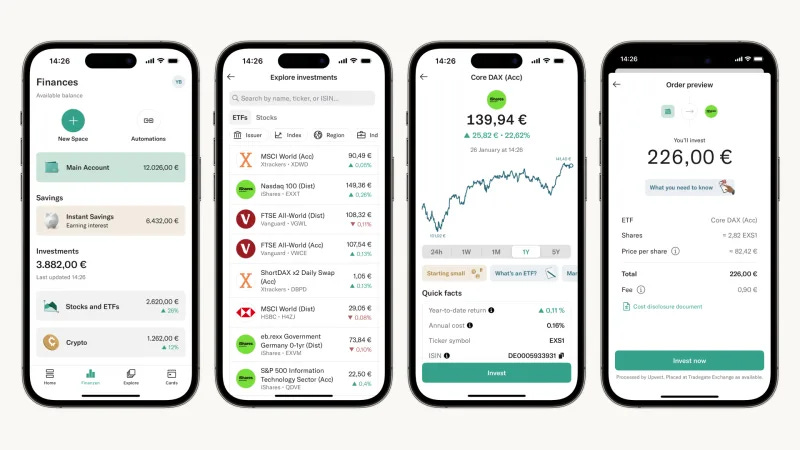

N26 Launches Low-Cost Stocks and ETF Trading Feature

N26 introduces a stocks and ETF trading feature in collaboration with Upvest, allowing users to trade for €0.90 per transaction through the N26 app. Initially launched in Austria, customers can invest in over 100 ETFs starting at one euro, with additional functions such as fee-free savings plans to be added soon. Orders can be placed outside market hours, but execution occurs when the market reopens. The product will later expand to include a full suite of more than 1000 stocks and ETFs for customers in Germany and Austria before being rolled out to other markets. While users are responsible for individual tax declarations, N26 will provide annual tax statements between March and April for the previous year. 🔗

Trade Republic Unveils Visa Card with Investing and Rewards

Trade Republic has unveiled a new Visa card merging daily payments with investing, offering customers a 1% Saveback reward for each card payment directed back into their savings plan. Users have the option to round up payments, investing the spare change into any asset. They can select between a Mirror card and a classic one for an issuance fee or opt for a free virtual card. The card carries no monthly fees and allows for worldwide free and unlimited ATM withdrawals, with a small fee for withdrawals under EUR 100. The debit card functions for both online and offline transactions. Despite attracting over 1 million registrations, according to Finanzszene, the card does not introduce any new functionalities. 🔗

Revolut Introduces Mobile Wallets for Instant International Transfers

Revolut introduces the Mobile Wallets feature, enabling customers to swiftly send international transfers using recipient IDs like names, phone numbers, or email addresses. Initially available for UK and most European customers, this feature supports transfers to Mobile Wallets in countries such as Bangladesh (bKash) and Kenya (M-Pesa), with more routes anticipated soon. Given the heavy reliance on Mobile Wallets in countries like Bangladesh and Kenya, Revolut's expansion into these markets offers convenient payment options for expats and international students. Transactions adhere to Revolut's standard pricing for international bank transfers, with processing times typically instant and funds arriving in the recipient's wallet within 30 minutes. This service aligns with Revolut's aim to provide convenient and cost-effective international money transfer options, enhancing ease and flexibility for customers. 🔗

Bunq Launches Finn: Personal AI Money Assistant

In December, bunq, Europe's second-largest neobank, launched it’s personal money AI assistant ‘Finn’. Finn is replacing the search function on buq app, offering features such as financial planning, budgeting, transaction tracking, and insights on spending. While Finn provides advanced answers to questions about users' finances and transactions, it does not offer financial advice. Available for both personal and business account users aged 16 and above, Finn can be accessed by tapping on the "Ask anything to Finn" bar on the home screen and typing or speaking a question. Users can ask about various aspects of their finances, from spending habits to specific transactions, and Finn can even provide contextual information, such as identifying past purchases or expenses at specific locations. 🔗

Apple's Proposal for NFC Access in EU Antitrust Case

Apple is seeking to resolve a 2022 antitrust case with the EU to avoid potentially hefty fines. As part of its proposed solution, Apple plans to grant third-party mobile wallet and payment service providers access to NFC functionality on iOS devices via free APIs, independent of Apple Pay or Apple Wallet. These APIs would enable equivalent access to NFC components, facilitating secure payment transactions. The proposed agreement would span 10 years and cover all third-party mobile wallet developers in the European Economic Area and iOS users with EEA-registered Apple IDs. Additionally, Apple pledges not to restrict the use of these apps for payments outside the EEA and promises features like default payment app selection and access to authentication features like FaceID. The European Commission is soliciting feedback from competitors and customers for one month regarding these proposed commitments. 🔗

Bawag Eyes €500M Deal for Barclays' German Finance Division

Bawag is in advanced negotiations to acquire Barclays' German consumer finance division, a deal estimated to be worth around €500 million ($539 million). The unit, based in Hamburg and employing 700 individuals, was put up for sale by Barclays in 2023. Formerly known as Barclaycard Germany, the business serves 2 million clients and held assets totaling £4.3 billion ($5.4 billion) at the end of the previous year. Societe Generale has also reportedly initiated the sale of a consumer finance business in Germany. 🔗

ABN Amro To Acquire Bux, Ending Crypto Services

ABN Amro announced its acquisition of online brokerage Bux to expand its presence among younger investors, with the transaction's financial details remaining undisclosed. Bux, known as one of the pioneering "neo brokers" in the Dutch market, boasts approximately 500,000 users across northern Europe and offers a smartphone app, small-scale stock trading, and zero commission on select orders. Despite posting a loss of €16.0 million ($17.4 million) on revenue of €2.52 million in 2022, Bux has garnered a significant user base. As part of the acquisition, ABN Amro intends to halt Bux's cryptocurrency offerings. 🔗

Google Pay Offers BNPL with Zip and Affirm for US Users

Google has partnered with Zip and Affirm to introduce buy now, pay later (BNPL) options for US consumers using Google Pay. Starting with a pilot in Q1 of 2024, Android users can choose Affirm or Zip as a payment method on select merchant apps and websites offering Google Pay at checkout. This allows users to split payments into installments using BNPL providers from the provided list. The service is currently available in the US only. 🔗

👓 Read our online magazine Fintech & Banking Innovation on Flipboard.

📩 Thank you for reading Beyond George! Subscribe for free to receive new posts and support our work.