Who's next?

The impact of the economic slowdown on financial institutions

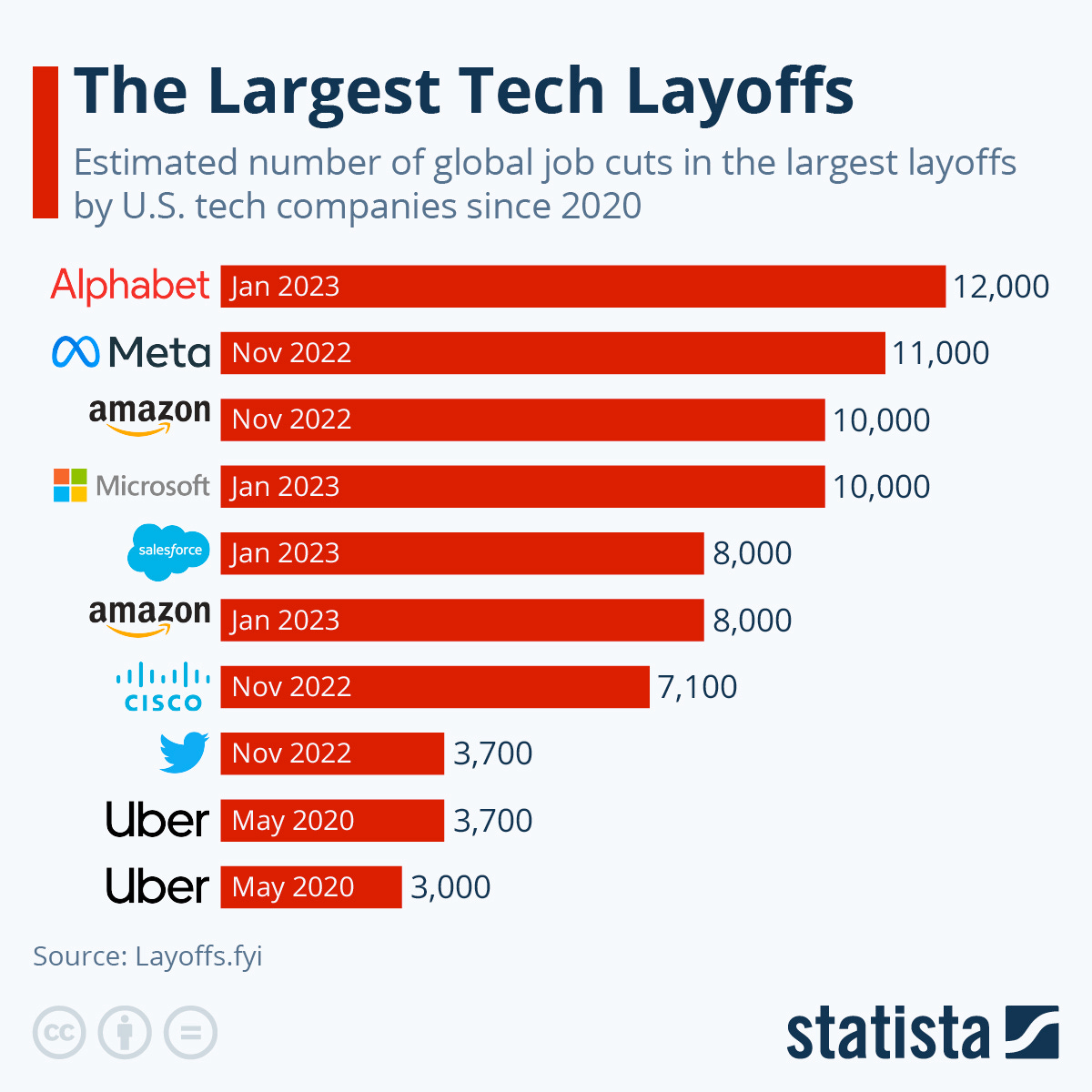

In the tech industry, it has been a tough few months. The economic slowdown has prompted hundreds of thousands of job cuts by startups and established tech giants alike.

Bloomberg's latest report shows that tech workers aren't the only ones facing job insecurity in 2023. Several banks are preparing for the largest round of job cuts since the global financial crisis. Thousands of layoffs are expected across the sector.

Fears of a potential recession are prompting several banks to cut staff and streamline operations. Especially in investment banking, banks are battling low deal activity, affecting equity and debt underwriting.

We’ve seen some warning shots from the US market. According to the Financial Times, banks including Credit Suisse, Goldman Sachs, and Morgan Stanley have cut more than 15,000 jobs in the past few months. Industry watchers expect others to follow.

In January 2023, Goldman Sachs began the process of laying off up to 3,200 employees, corresponding to 6.5% of the company's workforce. According to reports, Goldman saw its profits drop by 46% on revenue, which apparently led to cuts. Trading and banking units are expected to suffer the majority of job losses.

Although Morgan Stanley has a strong wealth management business, it laid off 1,800 employees in December last year. This is just over 2 percent of its workforce. James Gorman, Morgan Stanley CEO, recently referred to the bank's December layoffs as "overdue."

One of the biggest cuts announced was by Credit Suisse, which is currently revamping its strategy. The bank announced last October that it would reduce its workforce by 9,000 by 2025. In 2008, 7,000 employees were laid off as a result of the financial crisis. Due to social media reports about Credit Suisse's financial health, the bank saw huge withdrawals from clients in October 2022. Additionally, the bank is considering cutting its bonus pool by about 50% for 2022.

HSBC has already let go of at least 200 senior operations managers and many C-level executives across its global workforce.

In addition to reducing headcount, banks are taking other steps to reduce costs. Citigroup has so far provided few details about their layoff plans. But as a result of its investment bank's 22 percent drop in profits, there is pressure to cut costs.

In response to the situation, JPMorgan slashed bonuses by 30%.

It is not only banks that suffer from the economic downturn. One of the world's largest asset managers, BlackRock, announced it would cut around 500 jobs, which is less than 3% of its workforce.

The latest news comes from the US payment giant PayPal. Approximately 2,000 employees, or about 7% of its total headcount, are scheduled to be laid off in the near future.

Market experts contend that layoffs across industries are a correction after many companies experienced growth during the pandemic. The pandemic, and its associated booming profits, had deferred this inevitable process, but after the market's terrible 2022, it has resumed.

The Latest:

📍Raffeisen Czechia's own investing app

The Mobilní Investice mobile application should gradually replace the existing RBroker application. Customers can open an investment account, free of charge in a couple of minutes and invest in a range of investment products, on a one-off or regular basis. The service enables the purchase of ETFs, stocks, mutual funds, and investment certificates. There is no minimum balance required and you can start investing with 100 Czech crowns. They plan to allow fractional shares and fractional ETF purchases in the future, or the use of robo advisory services. Compared to the competition in the Czech market, Raiffeisen Mobilní Investice doesn't stand out with its product offering. The investment platforms Portu and Fondee offer the building of customers’ portfolios automatically, while in the Raiffeisen app, you choose the funds yourself. There is a fee of 0.11 to 0.20% on each purchase or sale of an investment product (minimum, however, 100 crowns), while at competitors like XTB, Portu, or Fondee, the transaction is free. 👉🏻 Explore Raiffeisen Mobilní Investice here

📍Klarna Money Stories

Klarna customers in the UK, US, Sweden, and Germany now have access to this new Spotify-like feature called ‘Money Story’ that provides a personal overview of their spending for 2022 in a social media savvy way. With the help of a personal spending summary, Klarna hopes to make money management more accessible. By visualizing spending patterns, Money Story makes it easy for consumers to understand their spending throughout the year. 👉🏻 Read more about Klarna Money Stories here

📍Global launch of Bitpanda Technology Solutions

The platform now allows fintechs, traditional banks, and online platforms to offer trading, investing and custody services across Stocks/ETFs, Cryptocurrencies, Precious Metals and Commodities. This infrastructure is set up as a modular system to allow partners to launch investment and custody offerings in as little as 3 months. The modular system enables partners to pick and choose from features such as savings plans, asset-to-asset swaps, crypto staking, fractionalized Stocks, (full) blockchain, custody and trading. With its initial White Label API, Bitpanda is already serving more than 20+ million customers. The offering has already attracted major fintech companies like the neobank N26, French fintech Lydia, UK fintech Plum, the Italian mobile bank Hype as well as the Italian open finance provider Fabrick 👉🏻 Explore Bitpanda Technology Solutions here

📍Soon Trade Republic Bank?

According to information from the media, Trade Republic has applied for a full banking license from the financial authority Bafin in Germany. The focus of Trade Republic has been securities such as shares, ETFs, or cryptocurrencies, so far. In the future, deposits and loans would also be possible. This is putting the fintech in direct competition with N26, which recently started to offer cryptocurrency trading.

📍🇦🇹 Austrian antithesis to Robinhood

Founded in March 2022, Froots ("financial roots") aims to provide private banking to everyone. The Froots approach combines financial planning and long-term asset management. The specially developed algorithm invests the capital in ETFs, stocks, bonds and gold, depending on the desired term and the preferred risk. Customers can join with a monthly payment of just 150 euros or an initial deposit of 3,000 euros. With 1% Froots takes an all-in approach to costs. There are no transaction fees. According to Froots the average investment horizon is 18 years. The average investor is between 30 and 45 years old and invests from 200 euros per month up to 100,000 euros as a one-off investment on average. As of now the company counts 600 customers but is aiming for 50,000 to 60,000 customers within the next two years. Froots has well-known investors on board. One of them is Andreas Treichl, former head of Erste Group and now Chairman of the Supervisory Board of Erste Foundation. Mr. Treichl holds 10 percent of Froots and sits on the advisory board. 👉🏻 Froots website (German only)

📍The Wüstenrot Bank 🇦🇹

Wüstenrot in Austria becomes an all-finance service provider, including a bank, a building society, and an insurance company. Wüstenrot wants to offer customers financial products from a single source: current accounts, savings, financing, insurance and pensions. With the new Wüstenrot app, it will be possible to access bank and credit cards, home savings contracts, loans and insurance in one place. The service should be rolled out to all Austrian private customers at the beginning of June 2023.

📍ECB outlined its vision for a digital euro app

The European Central Bank is considering the launch of a new digital euro app, which would include basic payment functionalities and with that create a standardized approach to connecting end users to intermediaries. This would also ensure that intermediaries—including smaller ones who may not want to invest money into setting up their own payment interface—keep their roles in digital euro distribution. The app would ensure that no matter where consumers travel in the euro area, the digital euro would always be recognized and they would be able to pay with it. The first release is likely to offer contactless payments, QR codes, and an easy way to pay online.

📍Revolut Ultra

In an effort to attract ambitious, affluent individuals interested in luxury lifestyles, Revolut is to roll out a super-premium membership plan. The new top-tier plan, Ultra, offers users free lounge access at 1,200 airports, cashback, and low fees on Revolut investment products. Coming in the Spring, Revolut is inviting new and existing customers to join a waitlist to unlock 5% cashback on purchases made in their first month with Ultra. Revolut has yet to reveal the price tag for Ultra. 👉🏻 Read more about Revolut Ultra here

Beyond George Suggests

📚 The UX of Banking: 900 days of progress by Built For Mars 👉🏻 Read here

📚 Lowering Remittance Costs, 2022 Report by Wise 👉🏻 Read here

📚 Fintech Futures´ Banking Technology Magazine /February 2023 issue 👉🏻 Read here

🗓️ AltFi’s second virtual Buy Now, Pay Later Forum, March 16th, 2023, free virtual event 👉🏻 Register here

On a final note:

Thank you for reading Beyond George! Subscribe for free to receive new posts and support our work.

Read also our online magazine Fintech & Banking Innovation on Flipboard. Click the Flipboard logo below for access 👇🏻